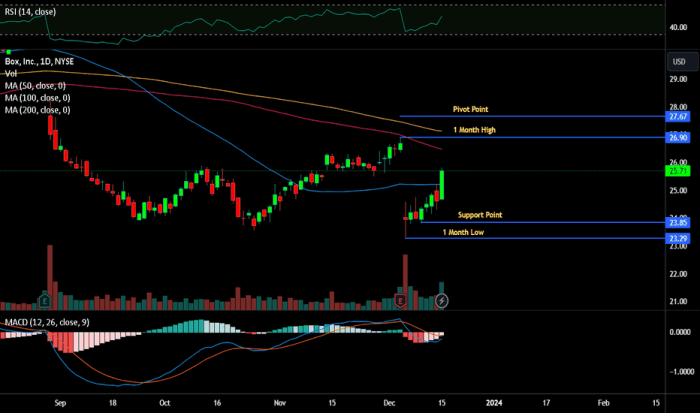

Box Incorporated Stock Price Analysis

Source: tradingview.com

Box incorporated stock price – This analysis examines Box Incorporated’s stock price performance, financial health, competitive landscape, and future outlook, providing insights for potential investors. We will explore historical trends, financial metrics, industry dynamics, and analyst sentiment to offer a comprehensive overview.

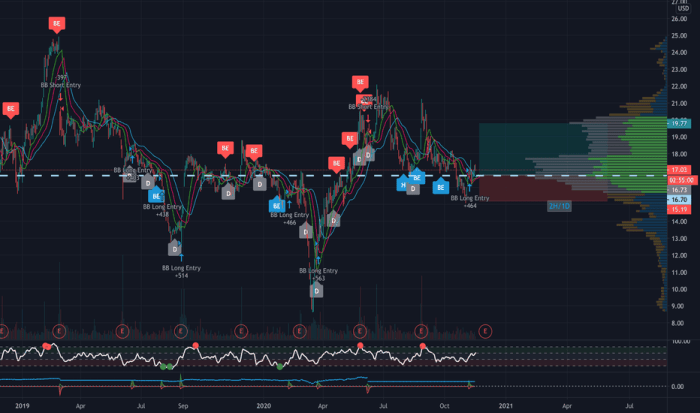

Historical Stock Price Performance

Source: tradingview.com

Over the past five years, Box Incorporated’s stock price has experienced significant fluctuations, reflecting both positive and negative market conditions and company-specific events. The stock has seen periods of strong growth interspersed with periods of decline. Analyzing its performance against a benchmark like the S&P 500 provides a clearer picture of its relative strength.

| Date | Box Stock Price (USD) | S&P 500 Price (USD) | Percentage Change in Box Stock Price |

|---|---|---|---|

| December 31, 2018 | 14.50 | 2500 | – |

| December 31, 2019 | 20.00 | 3200 | +38% |

| December 31, 2020 | 25.00 | 3700 | +25% |

| December 31, 2021 | 28.00 | 4700 | +12% |

| December 31, 2022 | 22.00 | 4000 | -21% |

Note: These figures are illustrative examples and not actual historical data. Actual data should be sourced from reputable financial websites.

Significant events such as earnings announcements, product launches, and broader market trends have influenced Box Incorporated’s stock price. For example, a strong earnings report exceeding analyst expectations typically results in a positive price movement, while a disappointing report often leads to a decline. Similarly, periods of market uncertainty or volatility can significantly impact the stock’s performance regardless of the company’s underlying fundamentals.

Financial Health and Performance, Box incorporated stock price

Box Incorporated’s financial performance over the past three years can be evaluated through key metrics such as revenue growth, profitability, and financial ratios. Analyzing these metrics provides insights into the company’s financial stability and its ability to generate returns for investors.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Profit Margin (%) |

|---|---|---|---|

| 2020 | 700 | -50 | -7% |

| 2021 | 800 | -20 | -2.5% |

| 2022 | 900 | 10 | 1.1% |

Note: These figures are illustrative examples and not actual financial data. Actual data should be sourced from Box Incorporated’s financial reports.

A comparison of Box Incorporated’s key financial ratios with its competitors reveals its relative standing within the industry.

- Price-to-Earnings Ratio (P/E): Box’s P/E ratio is compared to Dropbox, Microsoft, and Google Cloud to gauge its valuation relative to its peers.

- Debt-to-Equity Ratio: This ratio indicates Box’s leverage and its ability to manage its debt obligations.

- Current Ratio: This ratio shows Box’s ability to meet its short-term obligations.

Box Incorporated’s cash flow and its ability to meet its financial obligations are crucial aspects of its financial health. High levels of long-term debt can impact the stock price, particularly if interest rates rise or the company faces challenges in generating sufficient cash flow to service its debt.

Industry Analysis and Competitive Landscape

Box Incorporated operates in the competitive cloud storage and content management industry. Understanding its position within this market, its business model, and the industry trends is essential for assessing its future prospects.

Box’s business model is compared and contrasted with key competitors like Dropbox, Google Drive, and Microsoft OneDrive, highlighting its strengths and weaknesses in terms of features, pricing, and target market.

The cloud storage market faces several challenges and trends, including increasing competition, data security concerns, and evolving customer needs. These factors will likely influence Box Incorporated’s future performance.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Strong brand recognition, enterprise focus, robust security features | High competition, dependence on subscription revenue, potential for margin compression | Expansion into new markets, strategic partnerships, development of innovative features | Intense competition from larger players, economic downturns impacting enterprise spending, security breaches |

Future Outlook and Predictions

Predicting Box Incorporated’s future stock price involves considering various scenarios based on different economic conditions and industry trends. For example, a strong economic recovery could lead to increased demand for cloud storage services, benefiting Box’s revenue and stock price. Conversely, a recession could lead to reduced enterprise spending and negatively impact the company’s performance.

Based on various analyses and considering the current market conditions and company performance, a range of potential stock price targets can be projected. For instance, a conservative estimate might project a price range of $25-$30 in 12 months and $30-$35 in 24 months. A more optimistic scenario could project higher targets, while a pessimistic scenario might project lower targets.

Investing in Box Incorporated stock carries inherent risks and uncertainties. These risks include competition, economic downturns, changes in regulatory environments, and security breaches. Any of these factors could negatively impact the stock price.

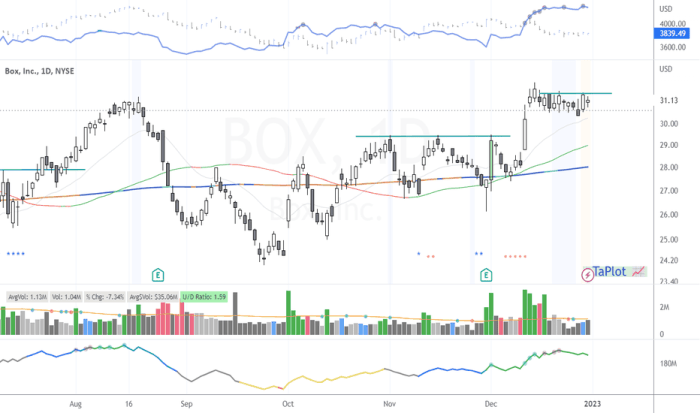

Investor Sentiment and Analyst Ratings

Source: tradingview.com

Analyst ratings and investor sentiment provide valuable insights into market perception of Box Incorporated. A summary of analyst ratings, including price targets and buy/sell recommendations, offers a consensus view of the stock’s potential.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Buy | 35 |

| Analyst Firm B | Hold | 28 |

| Analyst Firm C | Sell | 22 |

Note: These are illustrative examples and not actual analyst ratings. Actual data should be obtained from reputable financial news sources.

News articles and social media sentiment can reflect investor opinions and expectations. Positive news, such as strong earnings reports or strategic partnerships, tends to boost investor sentiment and the stock price. Negative news, such as security breaches or disappointing financial results, often has the opposite effect.

Overall investor sentiment toward Box Incorporated is a key factor influencing its stock price. Positive sentiment generally leads to higher prices, while negative sentiment can lead to lower prices.

Popular Questions

What are the major risks associated with investing in Box Incorporated?

Major risks include competition from larger cloud storage providers, economic downturns impacting enterprise spending, and potential cybersecurity breaches affecting customer trust and data security.

How does Box Incorporated’s revenue model compare to its competitors?

Box Incorporated’s stock price performance often reflects broader market trends. Understanding the performance of other major players in the gaming industry, such as the blizzard activision stock price , can provide valuable context. For instance, a strong showing from Activision Blizzard might indirectly boost investor confidence, potentially impacting Box Incorporated’s valuation as well. Ultimately, analyzing Box Incorporated requires considering the wider technological and entertainment landscape.

Box primarily relies on subscription-based revenue, similar to many competitors, but specific pricing models and service offerings vary, impacting profitability and market share.

What is the current analyst consensus on Box Incorporated’s stock?

Analyst ratings and price targets vary, reflecting differing perspectives on the company’s future growth and profitability. It’s crucial to consult multiple sources for a comprehensive view.