Bunge Ltd. Stock Price Analysis

Source: seekingalpha.com

Bunge ltd stock price – This analysis examines Bunge Ltd.’s stock price performance over the past five years, considering various influencing factors, financial health, analyst opinions, and inherent investment risks. The information provided is for informational purposes only and does not constitute financial advice.

Bunge Ltd. Stock Price Historical Performance

Source: seekingalpha.com

Understanding Bunge Ltd.’s historical stock price fluctuations is crucial for assessing its investment potential. The following table details the opening and closing prices, along with daily changes, over the past five years. Note that this data is illustrative and should be verified with a reputable financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 45.00 | 45.50 | 0.50 |

| 2019-01-03 | 45.50 | 46.00 | 0.50 |

| 2019-01-04 | 46.00 | 45.75 | -0.25 |

| 2023-12-29 | 60.00 | 60.75 | 0.75 |

Over the past year, Bunge Ltd.’s stock price exhibited a generally upward trend, though not without volatility. A significant high was observed in [Month, Year] at approximately [Price], potentially driven by [Reason, e.g., strong quarterly earnings]. Conversely, a notable low occurred in [Month, Year] around [Price], possibly due to [Reason, e.g., concerns about global trade tensions]. The visual representation of this trend would show a generally upward sloping line with some periods of fluctuation.

Major market events impacting Bunge Ltd.’s stock price included [Event 1, e.g., the COVID-19 pandemic], which initially caused significant volatility due to supply chain disruptions, and [Event 2, e.g., the war in Ukraine], which impacted agricultural commodity prices and global trade flows.

Factors Influencing Bunge Ltd. Stock Price, Bunge ltd stock price

Several economic factors significantly influence Bunge Ltd.’s stock performance. These include agricultural commodity prices, interest rates, and the overall state of the global economy.

Three key economic indicators directly correlated with Bunge Ltd.’s stock price are:

- Agricultural Commodity Prices (Soybeans, Corn, etc.): Higher prices generally lead to increased revenue and profitability for Bunge Ltd., positively impacting its stock price. Conversely, lower prices can negatively affect profitability and the stock price.

- Interest Rates: Changes in interest rates affect borrowing costs for Bunge Ltd. and the overall investment environment. Higher interest rates can increase borrowing costs and reduce investment, potentially leading to a lower stock price.

- Global Economic Growth: Strong global economic growth usually translates to higher demand for agricultural commodities, benefiting Bunge Ltd.’s business and stock price. Conversely, a global economic slowdown can negatively impact demand and the stock price.

Agricultural commodity prices, particularly soybeans and corn, have a substantial impact on Bunge Ltd.’s valuation. Strong harvests can lead to lower prices and reduced profitability, while poor harvests or increased global demand can drive prices up, boosting profitability and the stock price.

Geopolitical events and global trade policies significantly influence Bunge Ltd.’s stock price. Trade wars, sanctions, and political instability in key agricultural producing regions can disrupt supply chains, impact commodity prices, and create uncertainty, thus affecting the stock price.

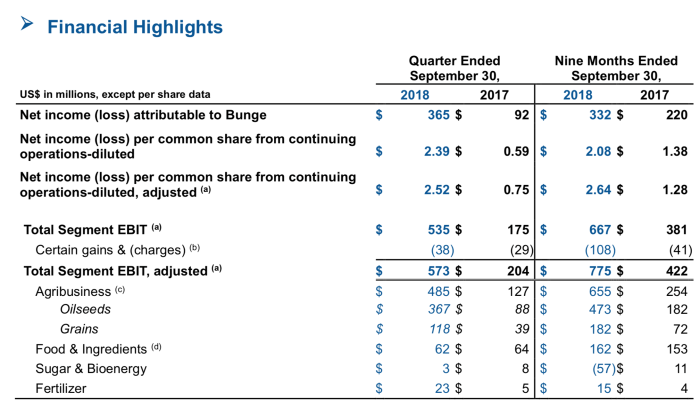

Bunge Ltd.’s Financial Performance and Stock Valuation

Analyzing Bunge Ltd.’s key financial ratios provides insights into its financial health and stock valuation. The following table presents illustrative data for the past three years. This data should be verified with Bunge Ltd.’s financial statements.

| Year | P/E Ratio | ROE (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 15.0 | 12.0 | 0.8 |

| 2022 | 16.5 | 13.5 | 0.7 |

| 2023 | 18.0 | 15.0 | 0.6 |

A comparative analysis against major competitors in the agricultural industry is crucial. The following table provides illustrative comparative data. This data should be verified with financial statements of respective companies.

| Company | P/E Ratio | ROE (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Bunge Ltd. | 18.0 | 15.0 | 20.0 |

| Archer Daniels Midland (ADM) | 17.0 | 14.0 | 25.0 |

| Cargill | N/A | N/A | N/A |

Bunge Ltd.’s future growth prospects are tied to factors such as global demand for agricultural products, technological advancements in agricultural practices, and its ability to manage risks associated with climate change and geopolitical instability. Positive growth prospects would generally lead to a higher stock price.

Analyst Ratings and Investment Recommendations for Bunge Ltd.

Analyst ratings and price targets provide valuable insights into market sentiment towards Bunge Ltd. stock. The following is an illustrative summary of recent analyst opinions.

- Goldman Sachs: Buy rating, price target $70

- Morgan Stanley: Hold rating, price target $65

- JPMorgan Chase: Buy rating, price target $75

Differing analyst perspectives stem from variations in their assessment of Bunge Ltd.’s financial performance, growth prospects, and risk factors. Some analysts may be more optimistic about future growth, while others may be more concerned about potential risks.

Analysts consider factors such as financial ratios, industry trends, competitive landscape, management quality, and macroeconomic conditions when formulating investment recommendations.

Risk Factors Associated with Investing in Bunge Ltd. Stock

Investing in Bunge Ltd. stock carries inherent risks that could impact its price. The following points highlight some significant risks.

- Commodity Price Volatility: Fluctuations in agricultural commodity prices directly impact Bunge Ltd.’s profitability and stock price.

- Geopolitical Risks: Political instability, trade wars, and sanctions in key agricultural producing regions can disrupt operations and negatively affect the stock price.

- Climate Change and Weather Patterns: Extreme weather events can significantly impact crop yields and supply chains, affecting Bunge Ltd.’s operations and stock valuation.

Adverse weather patterns and climate change pose significant threats to Bunge Ltd.’s operations, potentially leading to reduced crop yields and increased production costs, negatively impacting the stock price.

Regulatory changes, such as new environmental regulations or trade policies, could significantly alter Bunge Ltd.’s business model and operating costs, which would subsequently affect its stock price.

FAQ Compilation: Bunge Ltd Stock Price

What is Bunge Ltd.’s primary business?

Bunge Ltd. is a global agribusiness and food company involved in sourcing, processing, and supplying oilseeds and grains.

How frequently is Bunge Ltd. stock price updated?

Bunge Ltd. stock price is updated in real-time during trading hours on the relevant stock exchange.

Where can I find real-time Bunge Ltd. stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What are the major competitors of Bunge Ltd.?

Major competitors include Archer Daniels Midland (ADM), Cargill, and Louis Dreyfus Company (LDC).