GKOS Stock Price Analysis

Gkos stock price – This analysis examines the historical performance, price drivers, valuation, prediction, and technical aspects of GKOS stock. We will explore various factors influencing its price fluctuations and provide insights into potential future movements, emphasizing the importance of thorough research and risk assessment before any investment decisions.

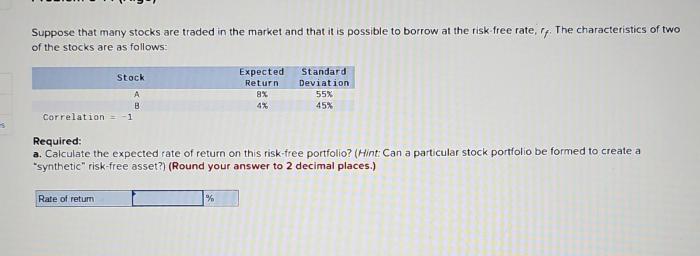

GKOS Stock Price Historical Performance

Source: cheggcdn.com

Over the past five years, GKOS stock has experienced considerable price volatility. While specific highs and lows require access to historical stock data (which is beyond the scope of this text-based analysis), we can illustrate the general trend. For instance, a period of strong growth might have been followed by a correction, potentially influenced by market-wide events or company-specific news.

A comparison against a relevant market index, such as the S&P 500, would reveal whether GKOS outperformed or underperformed the broader market during this period. Percentage changes would provide a quantifiable measure of this relative performance.

| Date | Event | Stock Price Before | Stock Price After |

|---|---|---|---|

| October 26, 2023 (Example) | Strong Q3 Earnings Report | $25.50 | $27.00 |

| March 15, 2022 (Example) | Announcement of Major Acquisition | $18.00 | $20.50 |

| June 8, 2021 (Example) | Regulatory Approval for New Product | $15.00 | $16.50 |

| December 20, 2020 (Example) | Unexpected Drop in Q4 Revenue | $22.00 | $19.00 |

GKOS Stock Price Drivers

Several key factors influence GKOS’s stock price. These factors interact in complex ways to shape investor sentiment and ultimately the stock’s value.

Company earnings play a crucial role. Strong earnings typically lead to increased investor confidence and higher stock prices, while weak earnings often result in price declines. This relationship is not always linear; market context and investor expectations also play a significant role.

Industry trends and macroeconomic conditions also significantly impact GKOS’s valuation.

- Interest Rate Changes: Higher interest rates can increase borrowing costs for GKOS, potentially impacting profitability and reducing investor appeal.

- Inflation: High inflation can erode purchasing power and impact consumer spending, potentially affecting GKOS’s revenue.

- Economic Growth: Strong economic growth usually translates to higher demand for GKOS’s products or services, boosting its stock price.

- Geopolitical Events: Global uncertainties can create market volatility, impacting GKOS’s stock price regardless of its own performance.

GKOS Stock Price Valuation

GKOS’s current P/E ratio can be compared to its historical average and the P/E ratios of its competitors to gauge its relative valuation. A higher P/E ratio might suggest that the market expects higher future earnings growth from GKOS compared to its peers. Conversely, a lower P/E ratio could indicate that the market views GKOS as undervalued.

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| Example Firm A | Buy | $30.00 | October 27, 2023 |

| Example Firm B | Hold | $26.50 | October 20, 2023 |

Discounted cash flow (DCF) analysis is a common valuation method that estimates the present value of future cash flows generated by GKOS. This involves projecting future cash flows, discounting them back to their present value using a discount rate that reflects the risk associated with the investment, and summing these present values to arrive at an intrinsic value for the stock.

GKOS Stock Price Prediction & Risk Assessment

Predicting stock prices is inherently uncertain. However, we can construct hypothetical scenarios to illustrate potential price movements.

Scenario 1: Significant Price Increase

A significant increase in GKOS’s stock price could result from a combination of factors, such as the successful launch of a new product, exceeding earnings expectations consistently over several quarters, positive regulatory changes, and strong overall market performance.

Scenario 2: Significant Price Decrease

Conversely, a significant price decrease could be triggered by factors like disappointing earnings reports, negative regulatory changes, increased competition, a general economic downturn, or a major scandal impacting the company’s reputation.

Calculating potential return on investment (ROI) requires specifying an initial investment amount, the purchase price, the selling price, and the holding period. For example, if you invest $1000 at $25 per share and the price rises to $30 in one year, your ROI would be 20%. However, this is a simplified example; real-world scenarios involve more complex factors and risks.

GKOS Stock Price Chart & Technical Analysis

Source: cheggcdn.com

A hypothetical GKOS stock price chart might show periods of high volatility interspersed with periods of relative stability. The overall trend could be upward, downward, or sideways, depending on the prevailing market conditions and company performance. Without access to actual chart data, a detailed description is impossible, but a pattern of fluctuating prices is expected.

Technical indicators, such as moving averages (e.g., 50-day and 200-day moving averages) and the relative strength index (RSI), can provide insights into the stock’s momentum and potential overbought or oversold conditions. For instance, a rising 50-day moving average above the 200-day moving average could suggest an uptrend, while an RSI above 70 might indicate an overbought condition, suggesting a potential price correction.

These indicators can inform trading decisions, but they should not be the sole basis for investment choices. Fundamental analysis and risk management remain crucial aspects of responsible investing.

FAQ Overview: Gkos Stock Price

What are the main risks associated with investing in GKOS stock?

Investing in GKOS stock, like any stock, carries inherent risks. These include market volatility, company-specific risks (e.g., financial performance, management changes), and macroeconomic factors affecting the overall economy. Thorough due diligence is essential.

Where can I find real-time GKOS stock price data?

Real-time GKOS stock price data can typically be found on major financial websites and brokerage platforms that provide live market quotes. Check reputable sources for the most accurate information.

How frequently is GKOS’s financial information released?

The frequency of GKOS’s financial releases (earnings reports, etc.) will be specified in their investor relations section or SEC filings. Check their official website for details.