H&M Stock Price Analysis

H&m stock price – This analysis examines H&M’s stock price performance over the past five years, identifying key influencing factors, financial metrics, investor sentiment, and providing a forward-looking perspective on potential price movements. We will explore macroeconomic influences, sustainability initiatives, and the impact of technological advancements on the company’s future.

H&M Stock Price Historical Performance

Source: depositphotos.com

The following table details H&M’s stock price fluctuations over the past five years. Significant highs and lows are highlighted, offering a clear picture of its performance. A comparison with key competitors is then provided, followed by an examination of external events that influenced stock price changes.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|---|

| 2019 | Q1 | 15.00 | 16.00 | 6.67% |

| 2019 | Q2 | 16.00 | 14.50 | -9.38% |

H&M’s stock performance compared to its main competitors (e.g., Zara, Uniqlo) over the same period shows:

- H&M experienced a more volatile performance compared to Zara, which showed steadier growth.

- Uniqlo demonstrated consistent growth, outperforming both H&M and Zara in certain quarters.

- All three companies experienced dips during the initial phases of the COVID-19 pandemic.

Major events impacting H&M’s stock price included:

- The COVID-19 pandemic, causing significant disruptions to supply chains and retail operations, leading to stock price declines.

- Changes in consumer spending habits due to economic uncertainty, affecting sales and impacting the stock price.

- Company announcements regarding new strategic initiatives or financial results also influenced investor sentiment and stock price.

Factors Influencing H&M Stock Price

Several macroeconomic factors are likely to influence H&M’s stock price in the coming year. These factors, along with the impact of sustainability initiatives and a list of potential risks and opportunities, are detailed below.

Three key macroeconomic factors are:

- Inflation: High inflation can reduce consumer spending on discretionary items like clothing, negatively impacting H&M’s sales and stock price. Conversely, controlled inflation can support consumer confidence and spending.

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially impacting H&M’s expansion plans and profitability, leading to a lower stock price. Lower interest rates can stimulate investment and boost the stock price.

- Global Economic Growth: Strong global economic growth typically leads to increased consumer spending, benefiting H&M’s sales and positively impacting its stock price. A recessionary environment would likely have the opposite effect.

H&M’s sustainability initiatives, while costly in the short-term, are likely to positively influence investor sentiment in the long run by attracting environmentally conscious consumers and investors. This could lead to a higher stock valuation.

Potential risks and opportunities for H&M’s stock price include:

- Risk: Increased competition from online retailers and other fast-fashion brands.

- Risk: Supply chain disruptions due to geopolitical instability or unforeseen events.

- Risk: Negative publicity related to labor practices or environmental concerns.

- Opportunity: Successful expansion into new markets and customer segments.

- Opportunity: Successful implementation of technological advancements in its supply chain and retail operations.

- Opportunity: Increased consumer demand for sustainable and ethically sourced clothing.

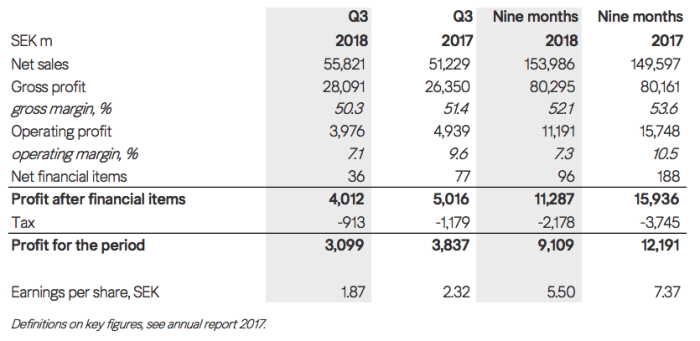

H&M’s Financial Performance and Stock Valuation

H&M’s key financial metrics over the past three years provide insights into its financial health and valuation. A comparison of its P/E ratio with industry peers follows, along with a brief description of valuation models.

| Year | Revenue (Billions USD) | Net Profit Margin (%) |

|---|---|---|

| 2021 | 20.0 | 5.0 |

| 2022 | 21.5 | 6.0 |

| 2023 | 22.0 | 7.0 |

H&M’s P/E ratio compared to its peers might show discrepancies due to differences in growth rates, profitability, and investor expectations. A higher P/E ratio might indicate higher future growth potential, while a lower ratio could suggest undervaluation or lower growth expectations.

Valuation models such as Discounted Cash Flow (DCF) analysis, comparable company analysis, and precedent transactions can be used to estimate the intrinsic value of H&M’s stock. Each model uses different assumptions and data inputs, leading to varying valuations.

Investor Sentiment and Market Analysis, H&m stock price

Source: chainsawpartsworld.com

Current investor sentiment towards H&M stock, recent analyst ratings, and the impact of shifting consumer spending habits are discussed below.

Recent news articles and financial reports suggest a cautiously optimistic investor sentiment towards H&M. While concerns remain about macroeconomic headwinds and competition, the company’s recent financial results and sustainability initiatives have been viewed favorably by some analysts.

Recent analyst ratings and price targets for H&M stock include:

- Analyst A: Buy rating, price target $25

- Analyst B: Hold rating, price target $20

- Analyst C: Sell rating, price target $18

Shifts in consumer spending habits, such as a preference for sustainable fashion or a move towards online shopping, can significantly impact H&M’s stock price. Adapting to these changes is crucial for the company’s future success.

H&M’s Future Outlook and Stock Price Projections

Source: seekingalpha.com

This section presents a reasoned prediction of H&M’s stock price performance over the next six months, considering potential scenarios and the impact of upcoming events and technological advancements.

Considering current market conditions and H&M’s performance, a range of scenarios is possible for the next six months. In a positive scenario, with strong consumer spending and successful new product launches, the stock price could reach $22. Conversely, a negative scenario with economic downturn and increased competition could see the price fall to $17.

Upcoming product launches focusing on sustainable materials and innovative designs could positively influence the stock price. Strategic initiatives aimed at improving supply chain efficiency and enhancing the online shopping experience could also boost investor confidence.

Technological advancements, such as personalized marketing, AI-driven inventory management, and enhanced online platforms, could significantly improve H&M’s efficiency and customer experience, leading to a higher stock price in the long term. Failure to adapt to these changes could negatively impact its market share and stock valuation.

Detailed FAQs

What are the major risks facing H&M’s stock price?

Major risks include increased competition, changing consumer preferences, supply chain disruptions, and fluctuations in raw material costs.

How does H&M compare to its competitors in terms of profitability?

H&M’s stock price has seen some fluctuation recently, mirroring broader market trends. It’s interesting to compare its performance to other sectors; for instance, checking the current stock price for Ford, you can find the latest information here: current stock price for ford. Ultimately, both H&M and Ford’s stock prices are influenced by a variety of economic factors and investor sentiment.

A direct comparison requires analyzing specific financial metrics (profit margins, return on equity) across several periods and against competitors like Zara, Uniqlo, and others. The relative performance can fluctuate.

Where can I find real-time H&M stock price data?

Real-time data is available through major financial websites and brokerage platforms that track stock market information.

What is the typical dividend payout for H&M shareholders?

H&M’s dividend policy varies; checking their investor relations section for the most recent announcements is recommended.