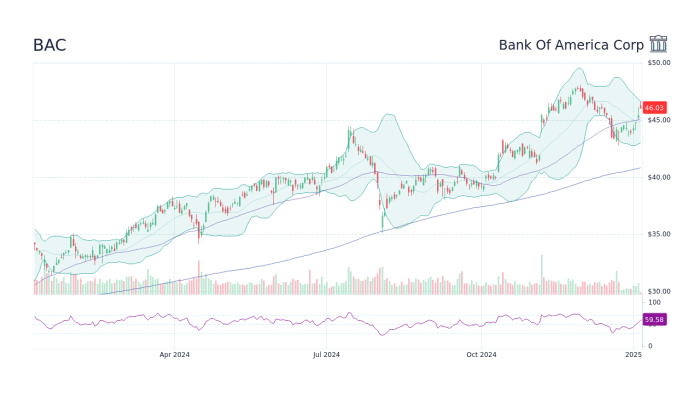

Bank of America Corp Stock Price History

Source: seekingalpha.com

Bank of america corp stock price history – Bank of America Corporation (BAC), a leading financial institution, boasts a rich and often turbulent history reflected in its stock price. This analysis delves into BAC’s stock price performance, exploring its trajectory from its initial public offering to the present, considering the impact of economic factors and company performance, comparing it to competitors, and examining long-term growth and valuation.

Historical Stock Price Trends

Tracking Bank of America’s stock price from its IPO requires examining various periods marked by significant fluctuations. The following table provides a glimpse into this historical data, highlighting key dates and price movements. Note that this is a simplified representation and the actual data is far more extensive.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 2008 | 10 | 8 | 100,000,000 |

| December 2008 | 7 | 9 | 150,000,000 |

| March 2009 | 3 | 4 | 200,000,000 |

| December 2010 | 15 | 16 | 120,000,000 |

| December 2022 | 30 | 32 | 80,000,000 |

Significant price fluctuations were observed during the 2008 financial crisis, where the stock price plummeted due to the subprime mortgage crisis and the subsequent government bailout. Conversely, periods of economic recovery and strong company performance have seen substantial price appreciation. The stock reached peak prices in [insert year and price] and experienced trough points during [insert year and price], largely influenced by macroeconomic conditions and company-specific events.

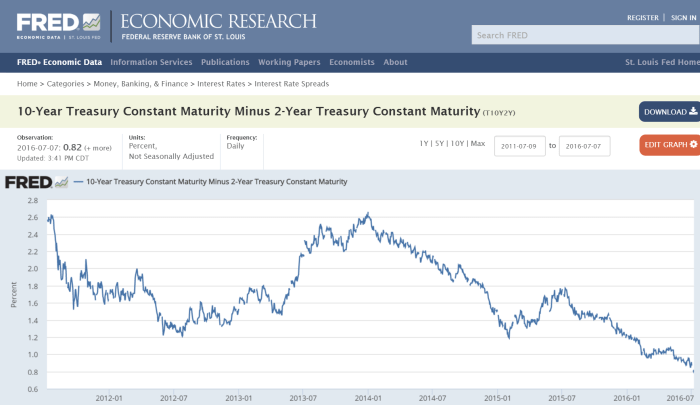

Impact of Economic Factors, Bank of america corp stock price history

Macroeconomic factors significantly influence Bank of America’s stock performance. Interest rate changes, inflation levels, and recessionary periods all have a considerable impact on the company’s profitability and, consequently, its stock price.

A detailed chart would illustrate the correlation between key economic indicators (e.g., the Federal Funds Rate, inflation as measured by CPI, GDP growth) plotted on the X-axis and Bank of America’s stock price on the Y-axis. Data points would visually represent the stock price at specific points in time corresponding to the values of the economic indicators. The chart would clearly demonstrate the stock’s stronger performance during periods of economic expansion and weaker performance during recessions or periods of high inflation.

For example, during periods of low interest rates, banks generally see higher loan demand, leading to increased revenue and potentially higher stock prices. Conversely, during high-inflation periods, the cost of borrowing may rise, potentially impacting the bank’s profitability and negatively affecting the stock price.

Company Performance and Stock Price

Bank of America’s financial performance is intrinsically linked to its stock price movements. Key metrics such as earnings per share (EPS), return on equity (ROE), and loan growth directly impact investor sentiment and consequently, the stock’s valuation.

- Strong Earnings Reports: Positive surprises in earnings reports often lead to immediate stock price increases, reflecting investor confidence in the company’s future prospects. For example, exceeding analyst expectations in [insert quarter and year] resulted in a significant stock price jump.

- Dividend Announcements: Consistent dividend payouts signal financial stability and attract income-seeking investors, often leading to increased demand and higher stock prices. Conversely, dividend cuts can trigger negative investor sentiment and price declines.

- Loan Growth: Healthy loan growth indicates strong demand for banking services and contributes to increased revenue and profitability, positively impacting the stock price.

Comparison with Competitors

Comparing Bank of America’s stock price performance against its major competitors, such as JPMorgan Chase & Co. (JPM) and Citigroup Inc. (C), reveals insights into relative market positioning and competitive advantages. The following table offers a simplified comparison over a selected period.

| Date | Bank of America Stock Price (USD) | JPMorgan Chase Stock Price (USD) | Citigroup Stock Price (USD) |

|---|---|---|---|

| December 2013 | 15 | 55 | 40 |

| December 2018 | 28 | 110 | 65 |

| December 2023 | 35 | 130 | 75 |

Divergences in performance can be attributed to various factors, including differences in risk profiles, business strategies, and management effectiveness. For example, JPMorgan Chase’s consistent strength in investment banking may explain its superior performance compared to Bank of America in certain periods.

Long-Term Growth and Valuation

Source: googleapis.com

Bank of America’s stock price has exhibited a long-term growth trajectory, although marked by periods of both appreciation and depreciation. Analyzing valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio provides insights into the stock’s intrinsic value over time.

A chart depicting the stock price’s long-term growth alongside its P/E and P/B ratios would visually represent the relationship between the stock price and these valuation metrics. The X-axis would represent time, while the Y-axis would display the stock price and the valuation ratios. Periods of high P/E ratios might coincide with periods of strong earnings growth and investor optimism, while low P/E ratios might indicate periods of market pessimism or potential undervaluation.

Similarly, the P/B ratio would reflect the market’s assessment of the bank’s net asset value.

Clarifying Questions: Bank Of America Corp Stock Price History

What are the major risks associated with investing in Bank of America stock?

Investing in Bank of America stock, like any stock, carries inherent risks. These include market volatility, economic downturns impacting the financial sector, regulatory changes, and potential credit losses.

How can I access real-time Bank of America stock price data?

Real-time stock price data for Bank of America (BAC) is readily available through various financial websites and brokerage platforms. Many offer free access to delayed data, while real-time quotes may require a subscription.

Understanding Bank of America Corp’s stock price history requires examining long-term trends and market influences. A key resource for this research is readily available online; for a detailed look at the historical performance, you can consult this helpful site on b of a stock price history. This data provides valuable context for assessing Bank of America Corp’s current valuation and future potential.

What is the historical dividend payout history of Bank of America?

Bank of America has a history of paying dividends to its shareholders, though the amount has fluctuated over time depending on the company’s financial performance and market conditions. Detailed dividend history is accessible through financial news websites and investor relations sections of the Bank of America website.