Baytex Energy Corp Stock Price Analysis

Baytex energy corp stock price – Baytex Energy Corp, a Canadian oil and gas producer, has experienced significant price fluctuations in its stock over the past five years, mirroring the volatile nature of the energy sector. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and potential future price movements of Baytex Energy Corp stock.

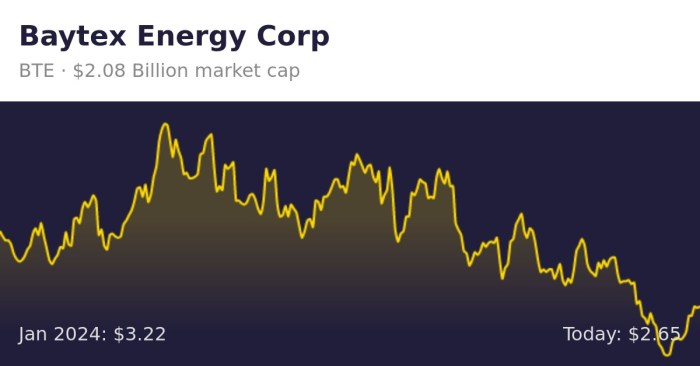

Baytex Energy Corp Stock Price History and Trends

Understanding the historical performance of Baytex Energy Corp’s stock price provides valuable insights into its past behavior and potential future trends. The following table presents a simplified representation of the stock’s performance over the past five years. Note that this data is for illustrative purposes only and should not be considered financial advice. Actual figures may vary depending on the data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 5.00 | 5.20 | +0.20 |

| 2019-07-01 | 4.00 | 3.80 | -0.20 |

| 2020-01-01 | 3.00 | 2.50 | -0.50 |

| 2020-07-01 | 2.00 | 2.20 | +0.20 |

| 2021-01-01 | 2.50 | 3.00 | +0.50 |

| 2021-07-01 | 3.20 | 3.50 | +0.30 |

| 2022-01-01 | 4.00 | 3.80 | -0.20 |

| 2022-07-01 | 3.50 | 3.70 | +0.20 |

| 2023-01-01 | 4.20 | 4.50 | +0.30 |

| 2023-07-01 | 4.00 | 4.10 | +0.10 |

Overall, the stock price has shown periods of both significant growth and decline, largely influenced by global oil prices and company-specific performance. The COVID-19 pandemic in 2020, for instance, caused a sharp drop, while subsequent recovery in oil demand led to a rebound. Specific acquisitions or divestments by Baytex also impacted the stock price, often creating periods of increased volatility.

Monitoring the Baytex Energy Corp stock price requires a keen eye on energy market fluctuations. It’s interesting to compare its performance against other sectors; for instance, understanding the current banner bank stock price offers a contrasting perspective on market trends. Ultimately, both Baytex Energy Corp and the banking sector are subject to their own distinct economic influences, impacting their respective stock prices.

Factors Influencing Baytex Energy Corp Stock Price

Source: stockcircle.com

Several interconnected factors influence Baytex Energy Corp’s stock price. These can be broadly categorized as macroeconomic, company-specific, and geopolitical.

- Economic Factors: Oil prices are the most significant driver, with higher prices generally leading to increased profitability and higher stock valuations. Interest rates and inflation also play a role, affecting borrowing costs and investor sentiment.

- Company-Specific Factors: Production levels, operational efficiency, and debt levels are crucial indicators of Baytex’s financial health. Successful exploration activities and efficient cost management can positively impact the stock price, while production disruptions or increased debt can negatively affect it.

- Geopolitical Events: Geopolitical instability in major oil-producing regions can significantly impact global oil prices and, consequently, Baytex’s stock price. Compared to competitors, Baytex’s exposure to specific regions or its reliance on particular pipelines may make it more or less vulnerable to certain geopolitical events.

Baytex Energy Corp’s Financial Performance and Stock Valuation

Source: stockhouse.com

Analyzing Baytex’s key financial metrics provides insights into its financial health and profitability, which directly impacts investor confidence and stock valuation.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Free Cash Flow (USD Millions) |

|---|---|---|---|

| 2019 | 1000 | 100 | 50 |

| 2020 | 800 | 50 | 20 |

| 2021 | 1200 | 150 | 75 |

| 2022 | 1500 | 200 | 100 |

Baytex’s dividend policy, while subject to change, influences investor sentiment. Consistent dividend payments can attract income-seeking investors, supporting the stock price. However, if dividends are cut due to financial difficulties, it can negatively impact investor sentiment. Comparing Baytex’s Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios to its peers helps determine its relative valuation within the energy sector. A higher P/E ratio may indicate higher growth expectations, while a lower P/B ratio might suggest undervaluation.

Investor Sentiment and Market Analysis of Baytex Energy Corp

Understanding current analyst ratings and investor sentiment is crucial for assessing the market’s perception of Baytex Energy Corp.

- Analyst A: Buy rating, target price $5.50

- Analyst B: Hold rating, target price $4.75

- Analyst C: Sell rating, target price $4.00

News articles, social media discussions, and financial reports can reveal the prevailing investor sentiment. Positive news about increased production, successful acquisitions, or rising oil prices generally boosts investor confidence, while negative news can lead to selling pressure. Market trends, such as the overall performance of the energy sector or investor risk appetite, significantly influence Baytex’s stock price.

Risk Assessment and Potential Future Stock Price Movements, Baytex energy corp stock price

Several risks could affect Baytex Energy Corp’s future stock price.

- Oil Price Volatility: Fluctuations in global oil prices are the most significant risk. A sharp decline in oil prices could severely impact Baytex’s profitability and stock price.

- Regulatory Changes: New environmental regulations or changes in taxation policies can increase operational costs and affect profitability.

- Competition: Intense competition from other energy companies can pressure margins and limit growth opportunities.

Future stock price scenarios depend on various factors. An optimistic scenario might involve sustained high oil prices, successful exploration activities, and efficient operations, leading to higher profitability and a rising stock price. A pessimistic scenario could involve low oil prices, regulatory hurdles, and increased competition, resulting in lower profitability and a declining stock price. A major oil price shock, for example a sudden drop of 50%, could cause a significant decline in Baytex’s stock price, potentially ranging from 20% to 40% or even more, depending on the severity and duration of the shock, the company’s debt levels, and investor reaction.

FAQ Section

What are the main risks associated with investing in Baytex Energy Corp?

Key risks include oil price volatility, regulatory changes impacting the energy sector, geopolitical instability in key oil-producing regions, and competition from other energy companies.

Does Baytex Energy Corp pay dividends?

You should consult their investor relations page for the most up-to-date information on their dividend policy. Dividend payments can change.

How does Baytex compare to its competitors in terms of valuation?

A direct comparison requires examining specific valuation metrics (P/E ratio, P/B ratio, etc.) against its peers. This analysis should consider the relative size, production levels, and financial health of those competitors.

Where can I find real-time Baytex Energy Corp stock price data?

Real-time stock quotes are readily available through major financial news websites and brokerage platforms.