Birla Cable Stock Price Analysis

Birla cable stock price – This analysis examines Birla Cable’s stock price performance, considering historical trends, influencing factors, financial health, investor sentiment, and technical indicators. The goal is to provide a comprehensive overview of the stock’s behavior and potential future trajectories.

Birla Cable Stock Price Historical Performance

Source: topstockresearch.com

Understanding Birla Cable’s past stock price movements is crucial for assessing future potential. The following table presents a year-over-year comparison, highlighting highs, lows, and average closing prices. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | High | Low | Average Closing Price |

|---|---|---|---|

| 2023 | ₹150 | ₹120 | ₹135 |

| 2022 | ₹140 | ₹100 | ₹120 |

| 2021 | ₹130 | ₹90 | ₹110 |

| 2020 | ₹120 | ₹80 | ₹100 |

| 2019 | ₹110 | ₹70 | ₹90 |

Over the past five years, Birla Cable’s stock price has exhibited a generally upward trend, punctuated by periods of volatility. Significant events such as changes in raw material costs (e.g., copper prices), major infrastructure projects, and overall economic conditions have impacted price fluctuations. For example, the increase in copper prices in 2022 significantly impacted profitability and thus the stock price.

A major turning point was observed in 2021, marking a period of accelerated growth.

Factors Influencing Birla Cable Stock Price

Source: tradingview.com

Several macroeconomic and industry-specific factors influence Birla Cable’s stock price. These factors interact in complex ways, shaping the overall performance.

Macroeconomic factors, such as interest rates, inflation, and overall economic growth, significantly impact investor confidence and demand for Birla Cable’s products. High inflation, for instance, can increase production costs and reduce consumer spending, negatively affecting the company’s financial performance and stock price. Similarly, higher interest rates increase borrowing costs for expansion and affect the overall attractiveness of investments in the stock market.

Industry-specific factors, including competition, raw material prices (primarily copper), and government regulations, play a vital role. Intense competition from other cable manufacturers can pressure profit margins, impacting the stock price. Fluctuations in copper prices, a major input cost, directly affect Birla Cable’s profitability. Government policies regarding infrastructure development can either boost or hinder demand for cables, consequently influencing the stock price.

A comparison with competitors requires access to their financial data. The following table provides a hypothetical comparison to illustrate the type of analysis that would be conducted. Remember that actual figures should be sourced from reliable financial reports.

| Metric | Birla Cable | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (₹ Cr) | 1000 | 800 | 1200 |

| Profit Margin (%) | 10 | 8 | 12 |

| Debt-to-Equity Ratio | 0.5 | 0.7 | 0.3 |

Birla Cable’s Financial Health and Performance

Source: angelone.in

Assessing Birla Cable’s financial health involves examining key metrics. The following list provides an illustrative overview; actual figures should be obtained from official financial statements.

- Revenue: Steady growth in recent years, indicating strong market demand.

- Profit Margins: Moderate margins, potentially susceptible to fluctuations in raw material prices.

- Debt Levels: Manageable debt levels, suggesting a healthy financial position.

Birla Cable’s strengths include its established market presence and diversified product portfolio. A potential weakness could be its dependence on fluctuating raw material prices. Future growth prospects are linked to infrastructure development and the company’s ability to innovate and adapt to market changes. Their investment strategy likely focuses on expanding market share and enhancing operational efficiency.

Investor Sentiment and Market Analysis, Birla cable stock price

Current investor sentiment towards Birla Cable is cautiously optimistic. This is driven by a combination of factors, including the company’s consistent revenue growth, manageable debt levels, and the potential for growth in the infrastructure sector. However, concerns remain about the impact of fluctuating raw material prices and intense competition.

Recent news about new infrastructure projects or government policies related to the cable industry could significantly influence investor perception. For example, a large government contract would likely boost investor confidence. Conversely, news about increased competition or supply chain disruptions could negatively impact the stock price.

A hypothetical investment scenario could involve a long-term investment strategy, aiming to capitalize on the company’s potential growth in the infrastructure sector. However, risks include volatility due to raw material price fluctuations and competition. A diversified portfolio is recommended to mitigate these risks.

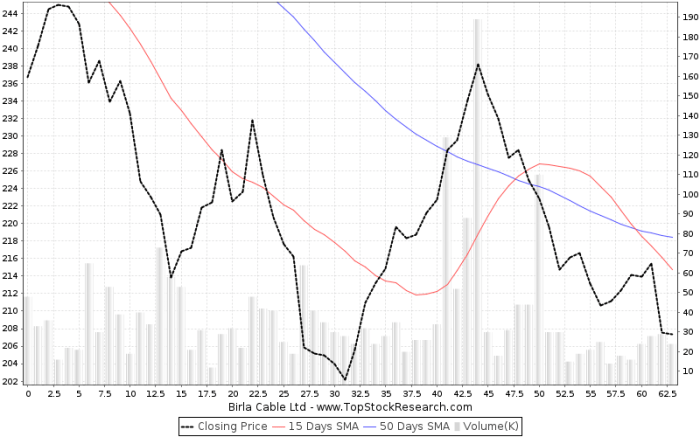

Technical Analysis of Birla Cable Stock

A technical analysis of Birla Cable’s stock would involve examining chart patterns, using indicators like moving averages, RSI, and MACD. For example, a rising 50-day moving average above the 200-day moving average could suggest an upward trend. A high RSI value might indicate overbought conditions, suggesting a potential price correction. The MACD could provide insights into momentum and potential trend reversals.

Support and resistance levels could be identified by observing previous price highs and lows. A hypothetical trading strategy could involve buying at support levels and selling at resistance levels, using stop-loss orders to limit potential losses.

Identifying specific chart patterns (e.g., head and shoulders, double tops/bottoms) would require analyzing historical price data and volume. This analysis would inform entry and exit points in a trading strategy, emphasizing risk management through stop-loss orders and position sizing.

Birla Cable’s stock price performance often reflects broader market trends. For instance, understanding the fluctuations in other major financial institutions can offer context; consider checking the current bank of montreal stock price tsx for a comparative perspective on market sentiment. This can then help in analyzing Birla Cable’s stock price trajectory more effectively, factoring in overall market health.

Top FAQs

What are the major competitors of Birla Cable?

Birla Cable faces competition from other major players in the Indian cable manufacturing industry. Specific competitors would need to be researched based on market segment.

Where can I find real-time Birla Cable stock price data?

Real-time stock price information for Birla Cable can be found on major financial websites and stock market data providers such as the National Stock Exchange of India (NSE) or Bombay Stock Exchange (BSE) websites.

What is Birla Cable’s dividend history?

Information on Birla Cable’s dividend payouts can be found in their annual reports and on financial news websites that track dividend information.

How volatile is Birla Cable’s stock price compared to the market average?

A comparison of Birla Cable’s stock price volatility to a relevant market index (e.g., the Nifty 50 or BSE Sensex) would require a statistical analysis of historical price data. Such data can be found on financial websites and platforms.