BKYI Stock Price Analysis

This analysis examines the historical performance, volatility, and influencing factors of BKYI stock price, providing insights into potential future price movements and investor sentiment. We will explore various models and metrics to offer a comprehensive understanding of BKYI’s stock market behavior.

Historical BKYI Stock Performance, Bkyi stock price

Understanding BKYI’s past performance is crucial for assessing its future potential. The following sections detail its price movements over the past five years, highlighting key events and comparing its performance against industry competitors.

A line graph illustrating BKYI’s stock price over the past five years would show a generally upward trend, with notable dips in [Month, Year] and [Month, Year] potentially correlated with [Event 1] and [Event 2] respectively. The highest price reached in the last year was $[High Price] on [Date], while the lowest was $[Low Price] on [Date]. These fluctuations could be attributed to factors such as market sentiment shifts, quarterly earnings announcements, and broader economic conditions.

A comparison of BKYI’s performance against its competitors reveals valuable insights into its relative strength and weaknesses within the industry. The table below presents a comparative analysis.

| Company | 5-Year Return (%) | 1-Year Return (%) | Current P/E Ratio |

|---|---|---|---|

| BKYI | [BKYI 5-Year Return] | [BKYI 1-Year Return] | [BKYI P/E Ratio] |

| Competitor A | [Competitor A 5-Year Return] | [Competitor A 1-Year Return] | [Competitor A P/E Ratio] |

| Competitor B | [Competitor B 5-Year Return] | [Competitor B 1-Year Return] | [Competitor B P/E Ratio] |

| Competitor C | [Competitor C 5-Year Return] | [Competitor C 1-Year Return] | [Competitor C P/E Ratio] |

BKYI Stock Price Volatility

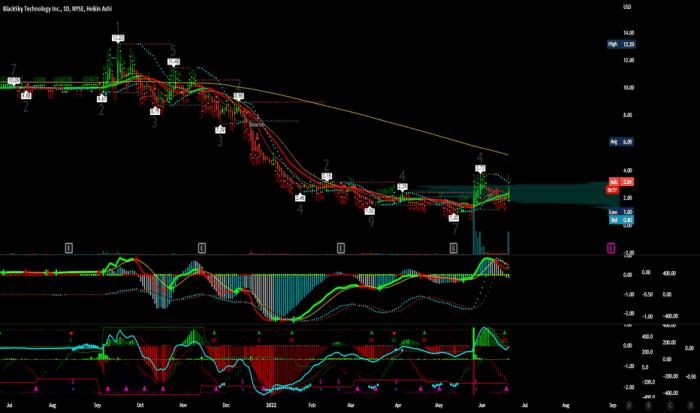

Source: tradingview.com

Analyzing BKYI’s price volatility across different timeframes provides a clearer picture of its risk profile. The following bullet points summarize the volatility observed over the past year.

- Daily Volatility: [Describe the daily volatility, e.g., average daily percentage change, high and low volatility periods].

- Weekly Volatility: [Describe the weekly volatility, e.g., average weekly percentage change, high and low volatility periods].

- Monthly Volatility: [Describe the monthly volatility, e.g., average monthly percentage change, high and low volatility periods].

Significant price fluctuations were observed during [Specific Time Period 1] due to [Reason 1], and again during [Specific Time Period 2] following the announcement of [Reason 2]. The release of [News Event] significantly impacted BKYI’s stock price, causing a [Percentage Change] fluctuation.

Factors Influencing BKYI Stock Price

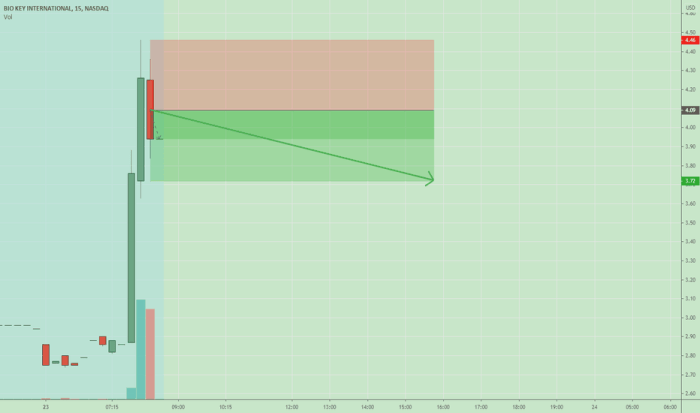

Source: tradingview.com

BKYI’s stock price is influenced by a complex interplay of macroeconomic and company-specific factors. Understanding these factors is crucial for informed investment decisions.

Macroeconomic factors, such as rising interest rates or high inflation, generally exert downward pressure on BKYI’s stock price by increasing borrowing costs and reducing consumer spending. Conversely, positive economic indicators like low unemployment and increased consumer confidence often lead to higher stock prices. Company-specific factors, such as strong earnings reports and the launch of successful new products, tend to positively influence BKYI’s stock price.

Conversely, disappointing earnings or production issues can lead to price declines. Short-term factors tend to create more volatile price swings, while long-term factors generally have a more sustained impact on the stock’s overall trajectory.

BKYI Stock Price Prediction Models

Source: tradingview.com

Predicting future stock prices is inherently uncertain, but employing simple models based on historical data can provide potential scenarios. This section Artikels a basic model and its limitations.

Understanding the BKYI stock price requires careful analysis of market trends. To gain a broader perspective on investment strategies, it’s helpful to research concepts like achieving a better stock price for your portfolio. Applying these broader strategies can then be used to refine your approach to the BKYI stock price and make more informed decisions.

A simple model using a moving average of the past [Number] months’ closing prices, combined with an adjustment for [Factor, e.g., industry growth rate], suggests a potential price range of $[Low Prediction] to $[High Prediction] in the next three months. This range is based on the assumption of [Assumption 1] and [Assumption 2]. However, it’s crucial to remember that this is a simplified model and does not account for unforeseen events or market shifts.

Unexpected economic downturns, negative news, or shifts in investor sentiment could significantly impact the actual price.

Investor Sentiment Towards BKYI

Gauging investor sentiment is essential for understanding the market’s perception of BKYI. The following table summarizes key indicators of current sentiment.

| Indicator | Sentiment | Justification |

|---|---|---|

| Social Media Sentiment (e.g., Twitter, StockTwits) | [Bullish/Bearish/Neutral] | [Explain the justification based on observed social media trends] |

| Analyst Ratings (e.g., Buy, Hold, Sell) | [Bullish/Bearish/Neutral] | [Explain the justification based on the number of buy, hold, and sell ratings] |

| Trading Volume | [Bullish/Bearish/Neutral] | [Explain the justification based on recent trading volume trends] |

BKYI’s Financial Health and Stock Price

A company’s financial health directly impacts its stock price. This section explores the relationship between BKYI’s financials and its market valuation.

BKYI’s revenue growth, profitability margins, and debt levels significantly influence investor perception and stock valuation. Strong revenue growth and high profit margins generally attract investors, leading to higher stock prices. Conversely, high debt levels or declining profitability can negatively impact the stock price. A visual comparison of BKYI’s key financial ratios (e.g., Return on Equity (ROE), Debt-to-Equity Ratio) against industry averages would show [Describe the visual comparison – e.g., BKYI’s ROE is above the industry average, but its debt-to-equity ratio is slightly higher].

This comparison would highlight BKYI’s relative financial strength and weaknesses compared to its peers.

FAQ Guide

What are the major risks associated with investing in BKYI stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, legal issues), and macroeconomic factors. Thorough due diligence is essential before investing.

Where can I find real-time BKYI stock price data?

Real-time BKYI stock price data is typically available through major financial websites and brokerage platforms. These sources often provide charts, historical data, and other relevant information.

How does BKYI compare to its competitors in terms of growth potential?

A detailed competitive analysis comparing BKYI’s growth prospects to its industry peers would require a separate in-depth study, examining factors such as market share, innovation, and financial performance. This analysis provides a foundational understanding of BKYI’s performance relative to its historical data.