Boundless Bio Stock Price Analysis

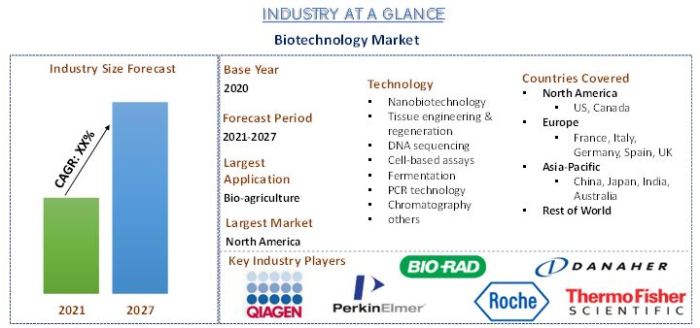

Source: univdatos.com

Boundless bio stock price – This analysis delves into the historical performance, influencing factors, financial health, risk assessment, and future outlook of Boundless Bio’s stock price. We will examine key metrics, compare it to competitors, and explore potential scenarios for future growth. Disclaimer: This analysis is for informational purposes only and does not constitute financial advice.

Boundless Bio Stock Price History and Trends

Understanding the historical trajectory of Boundless Bio’s stock price is crucial for informed investment decisions. Analyzing past performance, in conjunction with competitor analysis, provides a valuable context for assessing future potential.

A detailed timeline of Boundless Bio’s stock price performance over the past year would show significant highs and lows, pinpointing key dates and correlating them with relevant company announcements or market events. For example, a significant price increase might follow positive clinical trial results, while a decline could be linked to negative news or broader market downturns. A direct comparison against competitor stock prices within the biotechnology sector would illustrate Boundless Bio’s relative performance, highlighting areas of outperformance or underperformance.

A line graph illustrating stock price fluctuations over the past five years would visually represent the stock’s trajectory. Key events impacting the price, such as FDA approvals, major partnerships, or significant clinical trial updates, would be clearly marked on the graph, enabling a clear visualization of cause-and-effect relationships between events and price movements. The graph would allow for easy identification of trends, volatility periods, and overall performance compared to market benchmarks.

Factors Influencing Boundless Bio Stock Price

Several factors contribute to the fluctuations in Boundless Bio’s stock price. Understanding these factors is vital for predicting future price movements and managing investment risk.

Company news, such as positive clinical trial results leading to increased investor confidence and subsequent price appreciation, or negative news resulting in price drops, plays a significant role. Similarly, strategic partnerships can boost investor sentiment and drive up the stock price, while setbacks or delays can negatively impact the valuation. FDA approvals are pivotal events that can significantly influence the stock price, either positively or negatively depending on the outcome.

Macroeconomic factors, including interest rate hikes potentially reducing investment in riskier assets like biotech stocks, or inflationary pressures impacting consumer spending and overall market sentiment, exert considerable influence. A positive overall market sentiment generally benefits Boundless Bio, while negative sentiment can lead to price declines.

Investor sentiment and market speculation, driven by news, rumors, and overall market trends, contribute to stock price volatility. Positive speculation can lead to price increases, while negative speculation can trigger sell-offs and price drops. This element of unpredictability necessitates a thorough risk assessment before investing.

Boundless Bio’s Financial Performance and Stock Valuation

A comprehensive evaluation of Boundless Bio’s financial health is essential for assessing its stock valuation. Analyzing key financial metrics over time provides insights into the company’s growth trajectory and financial stability.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt (USD Millions) |

|---|---|---|---|

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

Key financial ratios, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are used to assess Boundless Bio’s valuation relative to its earnings and revenue. These ratios are compared to industry averages and competitor ratios to determine whether the stock is overvalued or undervalued. A comparative analysis of Boundless Bio’s valuation multiples against its main competitors provides context for its relative attractiveness in the market.

Risk Assessment for Boundless Bio Investment

Investing in Boundless Bio stock carries inherent risks. A thorough understanding of these risks is crucial for informed decision-making.

The inherent volatility of the biotech sector is a significant risk factor. Biotech stocks are often subject to substantial price swings due to the uncertainty associated with clinical trials, regulatory approvals, and market sentiment. Company-specific risks include the possibility of clinical trial failures, regulatory hurdles delaying or preventing product launches, and intense competition from other biotech companies. Market risks, such as economic downturns leading to reduced investor appetite for riskier assets, or shifts in investor sentiment towards the biotech sector, further contribute to the overall risk profile.

Future Outlook and Predictions for Boundless Bio Stock Price

Source: ufgroup.pro

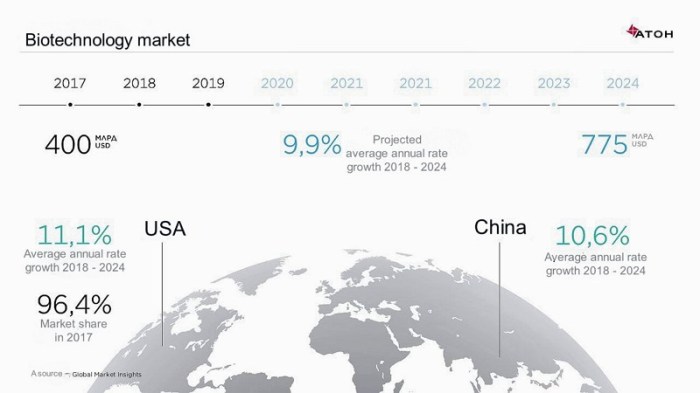

Predicting future stock price performance is inherently challenging, but analyzing potential scenarios based on various factors can provide a framework for understanding possible outcomes.

Understanding the boundless bio stock price requires considering the broader pharmaceutical market. A key competitor, and therefore a relevant comparison, is Bausch + Lomb, whose stock performance you can check here: bausch and lomb stock price. Analyzing Bausch + Lomb’s trajectory provides valuable context for assessing the potential future growth and volatility of the boundless bio stock price.

A projection of Boundless Bio’s potential stock price performance over the next 12 months might consider three scenarios: a bullish scenario assuming successful clinical trials and positive regulatory decisions; a neutral scenario assuming mixed results and moderate market conditions; and a bearish scenario assuming negative clinical trial results or regulatory setbacks. Each scenario would include a projected price range and the key factors driving that outcome.

For example, a successful Phase 3 clinical trial could significantly boost the stock price, while a failure could lead to a substantial decline. The impact of upcoming events, such as clinical trial data releases or regulatory decisions, would be factored into the projections, illustrating the potential range of price movements and the factors contributing to each scenario.

Expert Answers

What is Boundless Bio’s current market capitalization?

The current market capitalization fluctuates constantly and should be checked on a financial website providing real-time data.

Where can I buy Boundless Bio stock?

Boundless Bio stock can typically be purchased through major brokerage firms and online trading platforms. Check with your broker for availability.

What are the major competitors of Boundless Bio?

Identifying Boundless Bio’s key competitors requires further research into the specific niche within the biotech sector that the company operates. This information is usually available in company filings and industry reports.

What is the typical trading volume for Boundless Bio stock?

Trading volume varies daily and is readily available on financial websites that track stock market activity.