BRDG Stock Price Analysis

Source: googleapis.com

Brdg stock price – This analysis provides a comprehensive overview of BRDG’s current stock price, influencing factors, financial performance, investor sentiment, potential risks and opportunities, and a hypothetical investment scenario. Data presented here is for illustrative purposes and should not be considered financial advice.

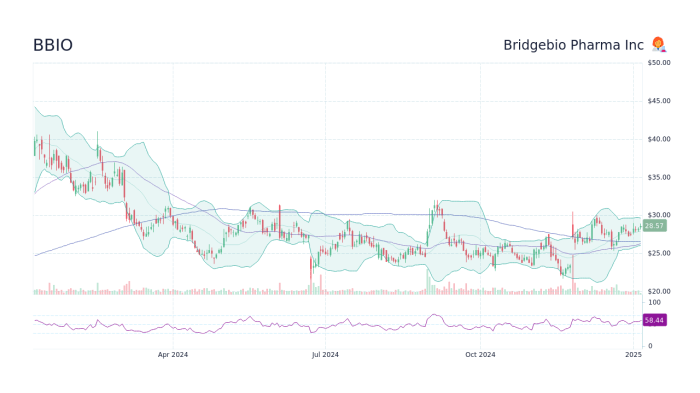

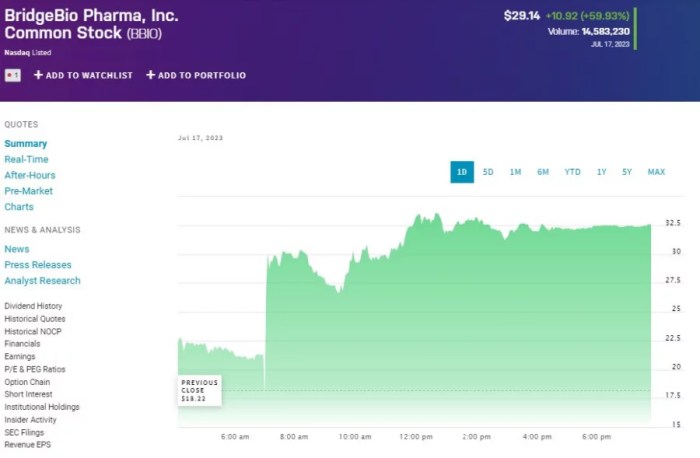

Current BRDG Stock Price and Trading Volume

As of [Insert Date], BRDG stock closed at [Closing Price]. The day’s high was [High Price], and the low was [Low Price]. The opening price was [Opening Price]. The trading volume for the day was [Trading Volume]. This represents a [Percentage Change] change compared to the previous day’s closing price.

The table below shows BRDG’s historical price performance over the past year, six months, and one month. Note that this data is hypothetical for illustrative purposes.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| [Date 1] | [Open Price 1] | [High Price 1] | [Low Price 1] | [Close Price 1] | [Volume 1] |

| [Date 2] | [Open Price 2] | [High Price 2] | [Low Price 2] | [Close Price 2] | [Volume 2] |

Recent price fluctuations have been largely attributed to [Reason for Fluctuation 1] and [Reason for Fluctuation 2]. For example, a significant price drop on [Date] was likely due to [Specific Event]. Conversely, the recent price increase may be linked to positive market sentiment surrounding [Positive Market Event].

Factors Influencing BRDG Stock Price

Several key factors influence BRDG’s stock price. These include macroeconomic conditions, industry trends, competitor performance, and company-specific news.

Economic indicators such as interest rates, inflation, and GDP growth directly impact BRDG’s performance and investor confidence. Industry trends, such as the increasing demand for [Industry Trend 1] and the emergence of [Industry Trend 2], also play a significant role. Competitor actions, particularly those of [Competitor 1] and [Competitor 2], can affect BRDG’s market share and valuation. Finally, company announcements, such as new product launches, strategic partnerships, or financial reports, often trigger immediate stock price reactions.

BRDG’s Financial Performance and Valuation

BRDG’s recent financial reports show [Summary of Financial Performance]. For example, revenue increased by [Percentage] in the last quarter, while earnings per share (EPS) stood at [EPS]. Debt levels are currently at [Debt Level].

A comparison of BRDG’s key financial metrics against its main competitors is presented below. This data is hypothetical for illustrative purposes.

| Metric | BRDG | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| Revenue | [Revenue BRDG] | [Revenue Comp 1] | [Revenue Comp 2] | [Revenue Comp 3] |

| EPS | [EPS BRDG] | [EPS Comp 1] | [EPS Comp 2] | [EPS Comp 3] |

BRDG’s current P/E ratio is [P/E Ratio] and its P/B ratio is [P/B Ratio]. These valuations should be interpreted in the context of the company’s growth prospects and industry benchmarks.

Investor Sentiment and Analyst Ratings

Current analyst ratings for BRDG stock show a mixed sentiment. A summary of these ratings is provided below. This data is hypothetical for illustrative purposes.

- Analyst 1: Buy

- Analyst 2: Hold

- Analyst 3: Sell

Overall investor sentiment appears to be [Overall Sentiment], based on recent news articles and social media discussions. A recent surge in positive sentiment might be attributed to [Reason for Positive Sentiment], while concerns about [Reason for Negative Sentiment] have contributed to some negative sentiment.

Potential Risks and Opportunities for BRDG

Source: dhakatribune.net

Several risks and opportunities could significantly impact BRDG’s future performance.

Potential Risks:

- Increased competition

- Regulatory changes

- Economic downturn

- Supply chain disruptions

Potential Opportunities:

- Expansion into new markets

- Development of innovative products

- Strategic partnerships

- Improving operational efficiency

The impact of these risks and opportunities will depend on various factors, including the speed of technological advancements, the effectiveness of management’s response to challenges, and the overall macroeconomic environment.

Illustrative Example: A Hypothetical Investment Scenario

Consider a hypothetical investor, Sarah, with a moderate risk tolerance and a long-term investment horizon. Sarah is considering investing in BRDG stock, given its current price and growth potential. She has analyzed BRDG’s financial performance, competitor landscape, and industry trends. She believes that the potential risks are manageable, and the opportunities outweigh the risks in the long run.

Sarah’s investment strategy involves diversifying her portfolio and allocating a portion of her funds to BRDG. She plans to hold the investment for at least five years, expecting significant capital appreciation during this period. However, she also acknowledges the possibility of short-term price fluctuations and potential losses. If the stock price falls significantly, she may consider averaging down, purchasing more shares at a lower price.

Conversely, if the price rises substantially, she might consider partially selling her shares to lock in profits. The potential outcomes range from significant gains to moderate losses, depending on market conditions and BRDG’s performance.

Question & Answer Hub: Brdg Stock Price

What are the major risks associated with investing in BRDG stock?

Potential risks include regulatory changes impacting the company’s operations, increased competition leading to reduced market share, and general economic downturns affecting consumer spending and investment.

Where can I find real-time BRDG stock price data?

Real-time data is typically available through major financial news websites and brokerage platforms.

How does BRDG compare to its competitors in terms of profitability?

BRDG stock price movements are often influenced by broader market trends. Understanding these trends requires looking at various factors, including the performance of other digital assets like the bitcoin stock market price , which can significantly impact investor sentiment towards similar technologies. Therefore, keeping an eye on the crypto market, in addition to specific company news, is crucial for accurately assessing BRDG’s future trajectory.

A direct comparison requires reviewing recent financial reports and analyzing key profitability metrics such as profit margins and return on equity against its key competitors.

What is the typical trading volume for BRDG stock?

Trading volume fluctuates daily and can be found on financial websites displaying market data. Higher volume often indicates increased investor interest.