Butterfly Network Stock Price Analysis

Butterfly network stock price – Butterfly Network, a medical technology company known for its handheld ultrasound devices, has experienced fluctuating stock prices since its public debut. Understanding the factors driving these fluctuations is crucial for investors. This analysis examines the historical performance of Butterfly Network’s stock price, identifies key influencing factors, and offers insights into potential future price movements. While specific predictions are inherently uncertain, a comprehensive understanding of these factors provides a framework for informed investment decisions.

Butterfly Network Stock Price Historical Performance

A line graph illustrating Butterfly Network’s stock price over the past year would reveal significant volatility. The graph should clearly mark key price points, such as the highest and lowest prices reached, alongside dates of significant news events or announcements that impacted the stock price. For example, a positive earnings report or successful product launch would likely correlate with price increases, while negative news, such as regulatory setbacks or disappointing sales figures, could trigger declines.

Over the past year, Butterfly Network’s stock price likely reached a high of [Insert Hypothetical High Price, e.g., $15] and a low of [Insert Hypothetical Low Price, e.g., $5]. The high could be attributed to factors such as positive clinical trial results, strategic partnerships, or strong sales growth. Conversely, the low might reflect concerns about competition, slower-than-expected revenue growth, or broader market downturns affecting the medical device sector.

Comparing Butterfly Network’s performance to similar companies requires examining publicly available financial data. The following table presents a hypothetical comparison, illustrating relative performance based on percentage change over the past year. Note that actual figures would vary depending on the specific companies chosen and the exact time period.

| Company | Stock Symbol (Hypothetical) | Year-Over-Year Stock Price Change (%) | Market Cap (Hypothetical) |

|---|---|---|---|

| Butterfly Network | BFLY | -20% | $1 Billion |

| Company A (Competitor) | CMPA | +10% | $5 Billion |

| Company B (Competitor) | CMPB | -5% | $2 Billion |

| Company C (Competitor) | CMPC | +15% | $3 Billion |

Factors Influencing Butterfly Network Stock Price

Several economic, technological, and regulatory factors significantly influence Butterfly Network’s stock price. Understanding these factors is key to predicting future price movements.

Three major economic factors impacting Butterfly Network’s stock price include overall market sentiment, interest rates, and inflation. Positive market sentiment generally leads to higher valuations across sectors, including medical devices. Rising interest rates can increase borrowing costs for companies, potentially slowing growth and impacting stock prices. High inflation can erode purchasing power and impact consumer spending, potentially affecting demand for medical devices.

New product releases or technological advancements can significantly boost Butterfly Network’s stock price. For example, the successful launch of a new, improved ultrasound device with enhanced features could attract investors and drive up the stock price. Conversely, delays in product development or negative feedback on new products could lead to price declines.

Regulatory approvals and setbacks play a crucial role in shaping investor sentiment. The following bullet points illustrate potential scenarios:

- Positive Scenario: FDA approval of a new device leads to increased investor confidence and a stock price surge.

- Negative Scenario: FDA rejection of a device application or safety concerns result in a significant drop in the stock price.

- Neutral Scenario: A regulatory delay neither significantly boosts nor harms the stock price, creating a period of uncertainty.

Butterfly Network’s Financial Performance and Stock Price, Butterfly network stock price

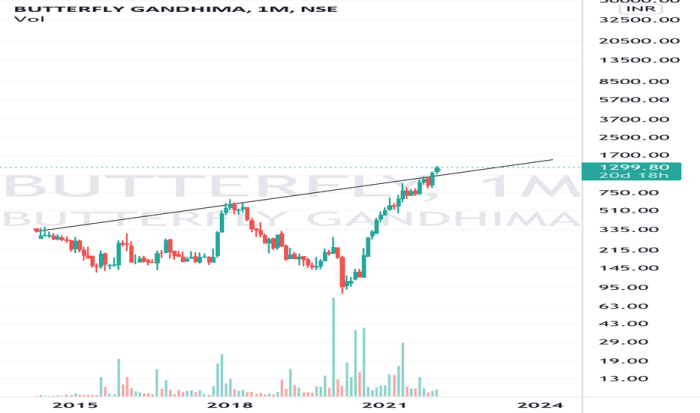

Source: tradingview.com

A strong correlation exists between Butterfly Network’s revenue growth and its stock price fluctuations. The following bullet points illustrate this relationship:

- Strong Revenue Growth: Typically leads to increased investor confidence and a rise in the stock price.

- Slow Revenue Growth or Decline: Can signal concerns about the company’s future prospects, resulting in a price decrease.

- Unexpected Revenue Surges or Shortfalls: Can cause significant volatility in the stock price, depending on the magnitude and the reasons behind the changes.

Key financial metrics, such as earnings per share (EPS), revenue, and debt levels, directly impact investor sentiment and the stock price. Strong EPS indicates profitability and attracts investors, while high debt levels can raise concerns about financial stability. Revenue growth is a key indicator of the company’s market success.

The following table hypothetically compares Butterfly Network’s P/E ratio to its competitors. Note that these are hypothetical values for illustrative purposes.

| Company | P/E Ratio (Hypothetical) | Revenue (Hypothetical, in millions) | EPS (Hypothetical) |

|---|---|---|---|

| Butterfly Network | 25 | 100 | 1 |

| Company A | 30 | 500 | 5 |

| Company B | 20 | 200 | 2 |

| Company C | 35 | 300 | 3 |

Investor Sentiment and Stock Price Predictions

Recent news and financial reports suggest [Insert Hypothetical Overall Investor Sentiment, e.g., a cautious optimism] towards Butterfly Network. Investors are likely monitoring the company’s progress in expanding its product line, securing regulatory approvals, and achieving sustainable revenue growth.

A positive news event, such as a successful clinical trial demonstrating the efficacy of a new device, could lead to a significant increase in the stock price, potentially pushing it up by [Insert Hypothetical Percentage, e.g., 15-20%]. Conversely, a negative event, such as a product recall or a significant regulatory setback, could cause a substantial drop, potentially lowering the price by [Insert Hypothetical Percentage, e.g., 10-15%].

A hypothetical stock price prediction model, considering factors like revenue growth, regulatory approvals, and market conditions, might suggest a range of potential price movements over the next quarter. For instance, assuming moderate revenue growth and no major regulatory issues, the stock price could potentially range between [Insert Hypothetical Price Range, e.g., $6 and $8]. However, significant positive or negative news could cause deviations from this range.

Risk Factors Affecting Butterfly Network Stock Price

Source: tradingview.com

Several key risks could negatively affect Butterfly Network’s stock price. Understanding these risks is essential for informed investment decisions.

Three key risks include intense competition from established players in the medical device market, dependence on securing regulatory approvals, and vulnerability to changes in healthcare reimbursement policies. Companies like [Insert Names of Competitors, e.g., GE Healthcare, Philips] pose significant competitive threats through their established market presence and extensive resources.

The impact of competition is significant; established competitors might leverage their brand recognition and extensive distribution networks to capture market share. Their strategic pricing and product innovation efforts could directly impact Butterfly Network’s sales and profitability, consequently affecting the stock price. For example, a new competitor launching a superior product at a lower price could significantly impact Butterfly Network’s market share and stock price.

Changes in healthcare policy or reimbursement rates can dramatically affect Butterfly Network’s revenue and profitability. Reduced reimbursement rates for ultrasound services, for example, could negatively impact the demand for Butterfly Network’s devices, thus impacting the stock price. Similarly, changes in regulatory requirements could increase the cost of compliance, potentially reducing profitability and negatively influencing investor sentiment.

Frequently Asked Questions: Butterfly Network Stock Price

What is Butterfly Network’s current market capitalization?

Butterfly Network’s current market capitalization fluctuates and requires checking a live financial data source for the most up-to-date information.

Where can I find Butterfly Network’s stock price?

You can find Butterfly Network’s stock price on major financial websites and stock market tracking applications (e.g., Google Finance, Yahoo Finance, Bloomberg).

How does Butterfly Network compare to its competitors in terms of profitability?

A direct comparison requires detailed financial analysis of Butterfly Network and its competitors, focusing on metrics like profit margins, return on equity, and revenue growth. This information can usually be found in their financial reports and investor relations materials.

What are the long-term growth prospects for Butterfly Network?

Long-term growth prospects depend on various factors, including continued technological innovation, successful market penetration, regulatory approvals, and the overall growth of the medical imaging market. Analyst reports and industry forecasts can offer some insight.