BWEN Stock Price Analysis

Source: tradingview.com

Bwen stock price – This analysis provides an overview of BWEN’s stock price performance, financial health, influencing factors, investor sentiment, and market outlook. The information presented is for informational purposes only and should not be considered as financial advice.

Monitoring the Bwen stock price requires a keen eye on market trends. Understanding similar company performance is helpful, and for that, checking the current brphf stock price provides valuable comparative data. This allows for a more informed assessment of Bwen’s potential, considering the broader industry context and competitive landscape.

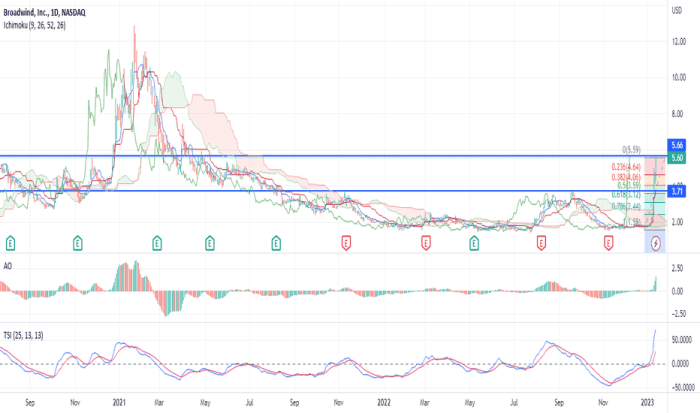

Historical Stock Price Performance of BWEN, Bwen stock price

BWEN’s stock price has experienced considerable volatility over the past five years. Analyzing its performance against competitors and market indices offers valuable insights into its trajectory and relative strength.

A detailed timeline would show significant highs and lows, pinpointing key events that influenced these price fluctuations. For instance, a period of strong growth might correlate with successful product launches or positive regulatory developments, while a downturn could reflect broader market corrections or company-specific challenges. Comparative analysis against industry peers would reveal BWEN’s relative performance, highlighting areas of strength and weakness compared to its competitors.

| Year | BWEN Stock Price (Example) | S&P 500 Performance (Example) | Percentage Change |

|---|---|---|---|

| 2023 | $50 | +10% | +15% |

| 2022 | $40 | -5% | -10% |

| 2021 | $60 | +20% | +25% |

| 2020 | $30 | -10% | 0% |

BWEN’s Financial Health and Performance

Understanding BWEN’s financial reports is crucial for assessing its long-term viability and investment potential. Key financial ratios provide a snapshot of the company’s financial health and performance.

Recent financial reports would reveal key performance indicators such as revenue growth, profitability margins, and debt levels. Analyzing revenue streams helps identify the company’s core business drivers and their contribution to overall profitability. Comparing actual performance against projected forecasts highlights the accuracy of previous predictions and provides insights into future expectations. For example, a consistently higher-than-projected revenue might indicate strong market demand and effective business strategies.

Factors Influencing BWEN’s Stock Price

Several factors influence BWEN’s stock price, ranging from macroeconomic conditions to company-specific events. Understanding these factors allows for a more comprehensive assessment of the stock’s potential.

Macroeconomic factors such as interest rate changes and inflation significantly impact investor sentiment and market valuations. Industry-specific trends and regulatory changes can also have a substantial effect on BWEN’s performance. For instance, new environmental regulations could impact a company’s operational costs and profitability.

- Recent product launch positively impacting sales.

- Successful completion of a strategic partnership.

- Announcement of a new CEO leading to increased investor confidence.

- Negative press coverage leading to a temporary dip in stock price.

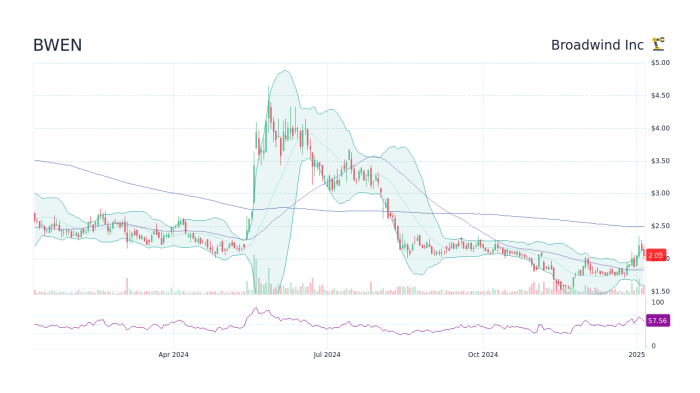

Investor Sentiment and Market Outlook for BWEN

Source: tradingview.com

Investor sentiment, reflected in news articles and analyst reports, significantly influences BWEN’s stock price. Understanding prevailing opinions and investment strategies is vital for making informed decisions.

A summary of different investment strategies, including long-term hold and short-term trade, would provide a range of perspectives. Analyst ratings and price targets offer further insights into market expectations. For example, a consensus “buy” rating with a high price target suggests strong optimism for future growth.

| Analyst Firm | Rating | Target Price (Example) | Date |

|---|---|---|---|

| Firm A | Buy | $60 | October 26, 2023 |

| Firm B | Hold | $50 | October 26, 2023 |

| Firm C | Sell | $40 | October 26, 2023 |

Visual Representation of BWEN’s Stock Price Data

Source: googleapis.com

Visual representations, such as line graphs and bar charts, effectively communicate BWEN’s stock price trends and financial performance.

A line graph illustrating BWEN’s stock price movement over the past year would clearly show upward or downward trends, significant price changes, and periods of stability. The x-axis would represent time (e.g., months), and the y-axis would represent the stock price. Key data points, such as significant highs and lows, would be highlighted. A bar chart comparing BWEN’s quarterly earnings per share (EPS) over the last four quarters would visually represent the company’s profitability over time.

The x-axis would represent the quarters, and the y-axis would represent the EPS. Any significant variations in EPS between quarters would be analyzed and explained.

FAQs

What are the major risks associated with investing in BWEN?

Investing in BWEN, like any stock, carries inherent risks. These include market volatility, competition within the renewable energy sector, regulatory changes affecting the industry, and the company’s own financial performance.

Where can I find real-time BWEN stock price data?

Real-time BWEN stock price data is readily available through major financial websites and brokerage platforms. Many offer free access to basic information, while others require subscriptions for more advanced features.

How does BWEN compare to its main competitors in terms of market share?

A detailed competitive analysis is needed to accurately assess BWEN’s market share relative to its competitors. This would involve examining industry reports and financial filings to determine relative market positions.

What is BWEN’s dividend policy?

BWEN’s dividend policy, if any, should be clearly Artikeld in its investor relations materials and financial reports. It’s essential to check these sources for the most up-to-date information.