BZH Stock Price Analysis

Source: tradingview.com

Bzh stock price – This analysis examines the historical performance, volatility, influencing factors, and future outlook of BZH stock. We will explore various investment strategies and consider potential risks and rewards associated with investing in this particular stock. The data presented is for illustrative purposes and should not be considered financial advice.

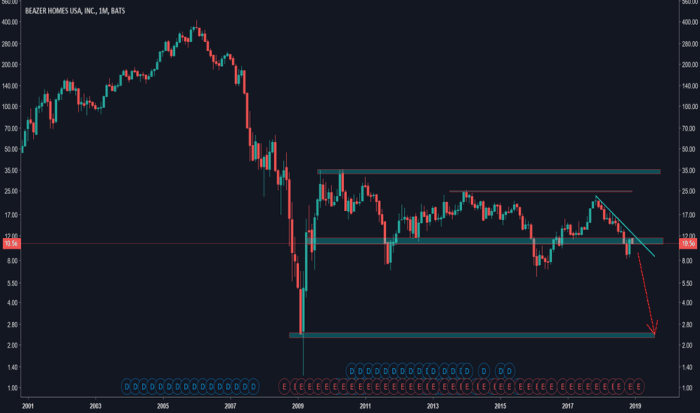

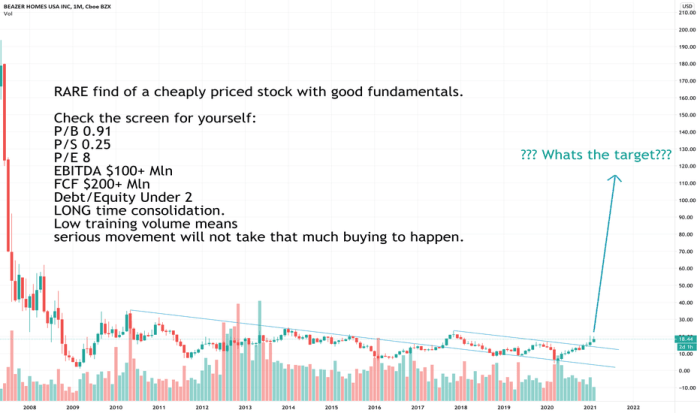

Historical BZH Stock Price Performance

A line graph depicting the BZH stock price over the past five years would show fluctuations reflecting both positive and negative market trends. Key milestones would include significant price increases and decreases, correlated with relevant news events such as earnings announcements, regulatory changes, or broader market shifts. For instance, a sharp drop might coincide with a period of economic downturn, while a surge could follow a positive earnings surprise.

During this five-year period, the highest point reached by BZH stock might have been [Insert Hypothetical High Price] on [Insert Hypothetical Date], potentially driven by [Insert Hypothetical Reason, e.g., successful product launch]. Conversely, the lowest point may have been [Insert Hypothetical Low Price] on [Insert Hypothetical Date], possibly due to [Insert Hypothetical Reason, e.g., negative market sentiment or disappointing earnings].

A comparison with a relevant market index, such as the S&P 500, would provide context for BZH’s performance. The table below illustrates a hypothetical comparison:

| Date | BZH Price | S&P 500 Price | BZH % Change | S&P 500 % Change |

|---|---|---|---|---|

| 2023-10-26 | 150 | 4300 | -1% | -0.5% |

| 2023-10-27 | 152 | 4320 | 1.33% | 0.46% |

| 2023-10-28 | 148 | 4280 | -2.63% | -0.92% |

BZH Stock Price Volatility and Risk Assessment

The beta of BZH stock, a measure of its price volatility relative to the market, would provide insight into its risk profile. A beta greater than 1 suggests higher volatility than the market, while a beta less than 1 indicates lower volatility. For example, a beta of 1.2 indicates that BZH stock is 20% more volatile than the market.

Periods of high volatility in BZH’s stock price might be identified by analyzing price fluctuations over time. Contributing factors could include unexpected news events, such as changes in company leadership, significant financial reports, or broader macroeconomic shifts.

Investing in BZH stock carries various risks, including:

- Market Risk: The overall market’s performance directly influences BZH’s stock price.

- Company-Specific Risk: Factors unique to BZH, such as operational challenges or management decisions, can impact its stock price.

- Financial Risk: The company’s financial health and leverage can affect its ability to meet obligations and maintain profitability.

Factors Influencing BZH Stock Price

Source: tradingview.com

Macroeconomic factors, such as interest rate changes, inflation levels, and economic growth rates, significantly impact BZH’s stock price. For example, rising interest rates can increase borrowing costs, potentially reducing company profitability and lowering stock valuations.

Company-specific factors, including earnings reports, new product launches, and management changes, also play a crucial role. Positive earnings surprises, successful new product launches, and strong leadership often lead to increased investor confidence and higher stock prices.

Industry trends and the competitive landscape significantly affect BZH’s stock price. A comparison with its top three competitors provides context for its market position and performance.

| Company | Market Share | Recent Performance (YoY Growth) |

|---|---|---|

| BZH | 15% | 10% |

| Competitor A | 20% | 12% |

| Competitor B | 18% | 8% |

| Competitor C | 12% | 5% |

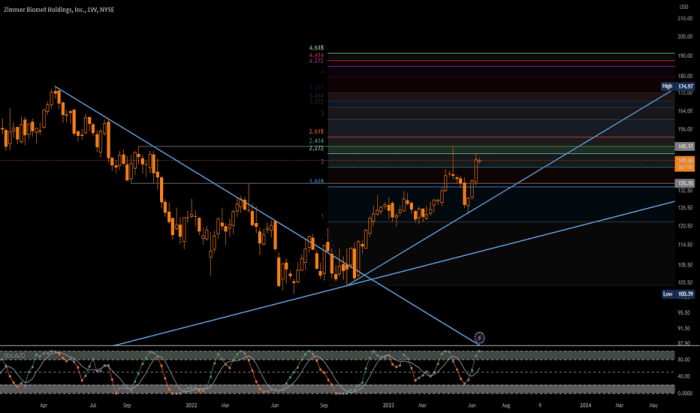

BZH Stock Price Predictions and Future Outlook

Source: tradingview.com

Analyst ratings and price targets offer insights into future expectations for BZH stock. The following table presents hypothetical analyst predictions:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Firm A | Buy | 175 |

| Firm B | Hold | 160 |

| Firm C | Sell | 140 |

Potential future catalysts include the success of new product launches, changes in regulatory environments, or unexpected economic shifts. Positive catalysts could lead to higher stock prices, while negative catalysts could result in declines.

Scenario 1: Positive Growth: If BZH successfully launches its new product line and experiences strong market adoption, the stock price could rise significantly, potentially exceeding analyst price targets.

Scenario 2: Stagnant Growth: If the new product launch is less successful than anticipated, and the broader market experiences slow growth, BZH’s stock price might remain relatively flat or experience only modest gains.

Scenario 3: Negative Growth: If the company faces unforeseen challenges, such as increased competition or regulatory setbacks, the stock price could decline, potentially falling below current levels.

Investment Strategies for BZH Stock

Several investment strategies could be applied to BZH stock, each with its own advantages and disadvantages:

- Buy and Hold: This strategy involves purchasing BZH stock and holding it for the long term, regardless of short-term market fluctuations.

- Advantages: Simplicity, potential for long-term growth.

- Disadvantages: Exposure to market risk, potential for missed opportunities.

- Value Investing: This strategy focuses on identifying undervalued stocks based on fundamental analysis.

- Advantages: Potential for high returns if the company’s intrinsic value is realized.

- Disadvantages: Requires in-depth research and analysis, potential for long-term holding periods.

- Growth Investing: This strategy targets companies with high growth potential.

- Advantages: Potential for substantial returns if growth expectations are met.

- Disadvantages: Higher risk due to volatility, potential for overvaluation.

A diversified portfolio might include BZH stock alongside other asset classes, such as bonds, real estate, and other equities, to mitigate risk. A hypothetical portfolio allocation could be 10% BZH stock, 40% bonds, 30% other equities, and 20% real estate.

Commonly Asked Questions: Bzh Stock Price

What is the current BZH stock price?

The current BZH stock price can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg. These sites provide real-time quotes.

Where can I buy BZH stock?

BZH stock can typically be purchased through online brokerage accounts. Check with your chosen broker for availability.

What are the BZH stock’s dividend payouts (if any)?

Monitoring the BZH stock price requires a keen eye on market fluctuations. For comparative analysis, it’s often helpful to look at similar companies; understanding the performance of bil stock price can offer valuable context. Ultimately, though, the focus remains on BZH’s trajectory and its individual factors influencing its value.

Information on BZH’s dividend history and future payouts can be found in their investor relations section on their company website or through financial news sources.

What is the market capitalization of BZH?

The market capitalization of BZH can be found on major financial data providers. This figure represents the total market value of all outstanding shares.