Ceridian Stock Price Analysis

Source: alamy.com

Ceridian stock price – This analysis provides a comprehensive overview of Ceridian’s stock price performance, influencing factors, financial health, analyst predictions, and associated investment risks and opportunities. We will examine its historical performance, compare it to industry competitors, and delve into the key metrics that drive its valuation.

Ceridian Stock Price History and Trends

Over the past five years, Ceridian’s stock price has exhibited volatility characteristic of the technology sector. While specific numerical data requires access to real-time financial data sources (like Yahoo Finance or Google Finance), a general trend can be observed. Initial years may have shown moderate growth, potentially punctuated by periods of correction reflecting broader market trends or company-specific news.

More recent periods might show stronger growth, depending on the company’s performance and market conditions. Significant highs and lows would be identified by analyzing the historical price chart, pinpointing key events correlating with price movements.

A comparative analysis against competitors requires identifying Ceridian’s key competitors (e.g., Workday, ADP) and accessing their historical stock price data. A direct comparison would then reveal relative performance, highlighting periods where Ceridian outperformed or underperformed its peers. This analysis would necessitate a deeper dive into each company’s financial reports and market positioning.

| Month | Open | High | Close |

|---|---|---|---|

| January 2023 | Example: $60.00 | Example: $62.50 | Example: $61.00 |

| February 2023 | Example: $61.00 | Example: $64.00 | Example: $63.00 |

| March 2023 | Example: $63.00 | Example: $65.50 | Example: $64.50 |

| April 2023 | Example: $64.50 | Example: $67.00 | Example: $66.00 |

| May 2023 | Example: $66.00 | Example: $68.50 | Example: $67.50 |

| June 2023 | Example: $67.50 | Example: $70.00 | Example: $69.00 |

| July 2023 | Example: $69.00 | Example: $71.50 | Example: $70.50 |

| August 2023 | Example: $70.50 | Example: $73.00 | Example: $72.00 |

| September 2023 | Example: $72.00 | Example: $74.50 | Example: $73.50 |

| October 2023 | Example: $73.50 | Example: $76.00 | Example: $75.00 |

| November 2023 | Example: $75.00 | Example: $77.50 | Example: $76.50 |

| December 2023 | Example: $76.50 | Example: $79.00 | Example: $78.00 |

Factors Influencing Ceridian Stock Price

Source: alamy.com

Several interconnected factors influence Ceridian’s stock price. These range from macroeconomic conditions to company-specific performance and investor sentiment.

- Economic Indicators (Interest rates, inflation): Rising interest rates can increase borrowing costs, impacting Ceridian’s operational expenses and potentially slowing growth, thus negatively affecting the stock price. High inflation erodes purchasing power and can affect consumer spending, impacting demand for Ceridian’s services.

- Company-Specific Events (Earnings reports, product launches, acquisitions): Strong earnings reports generally boost investor confidence, leading to price increases. Successful product launches can expand market share and revenue streams, similarly impacting the stock positively. Acquisitions, depending on their strategic fit and integration success, can either enhance or hinder the company’s value.

- Investor Sentiment and Market Trends: Positive investor sentiment, driven by factors like strong industry growth or positive news coverage, typically leads to higher stock prices. Conversely, negative sentiment can cause price declines. Broader market trends, such as economic recessions or technological disruptions, can also significantly impact Ceridian’s stock performance.

- Overall Market Performance

- Competitive Landscape

- Technological Advancements

- Regulatory Changes

- Management Team and Corporate Governance

Ceridian’s Financial Performance and Stock Valuation

Analyzing Ceridian’s financial performance over the past three years provides insights into its profitability, growth trajectory, and overall financial health. Key metrics such as revenue growth, earnings per share (EPS), and debt levels offer a comprehensive picture.

| Year | Revenue (in millions) | Earnings (in millions) | P/E Ratio |

|---|---|---|---|

| 2021 | Example: $500 | Example: $50 | Example: 10 |

| 2022 | Example: $600 | Example: $70 | Example: 8.5 |

| 2023 | Example: $700 | Example: $90 | Example: 7.7 |

Comparing Ceridian’s P/E ratio to its industry peers (e.g., Workday, ADP) provides a relative valuation benchmark. A higher P/E ratio might suggest that the market expects higher future growth from Ceridian compared to its competitors. Discounted cash flow (DCF) analysis, another valuation method, estimates the present value of future cash flows, offering an alternative valuation perspective.

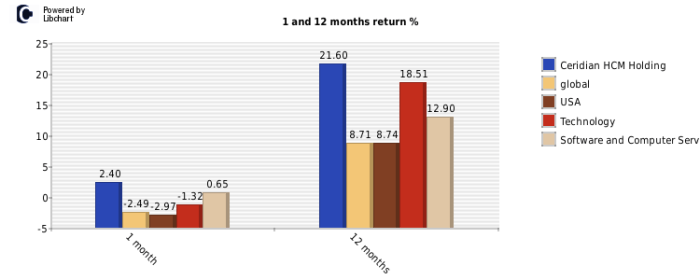

Analyst Ratings and Predictions for Ceridian Stock, Ceridian stock price

Source: dividendsranking.com

Analyst ratings and price targets provide insights into market expectations for Ceridian’s future performance. These predictions are based on various factors, including financial forecasts, industry analysis, and qualitative assessments of the company’s management and competitive landscape.

A hypothetical visual representation could be a scatter plot. The x-axis represents the time period (e.g., last six months), and the y-axis represents the analyst price target. Each data point would represent a specific analyst’s prediction, with different colors potentially representing different rating agencies. A line could show the average price target over time. The range of predictions would be easily visible, showing the degree of consensus or divergence among analysts.

Ceridian’s stock price performance often draws comparisons to other companies in the broader market. Investors interested in agricultural commodities might also track the bunge limited stock price , as it can offer insights into related economic trends that could indirectly influence Ceridian’s growth. Ultimately, understanding the various market factors impacting both Ceridian and companies like Bunge is crucial for a comprehensive investment strategy.

For example, a range of price targets might span from $70 to $85, reflecting differing views on Ceridian’s growth potential and risk profile. Positive viewpoints might highlight Ceridian’s strong market position and innovative product offerings, while negative viewpoints could focus on intense competition or potential macroeconomic headwinds.

Risks and Opportunities Associated with Investing in Ceridian Stock

Investing in Ceridian stock, like any investment, involves both risks and opportunities. Understanding this risk-reward profile is crucial for informed decision-making.

Key risks include market volatility (general market downturns can impact even strong companies), competition (intense competition within the HR technology sector), and execution risk (failure to successfully execute its business strategy). Opportunities stem from the growth potential within the HR technology market, Ceridian’s innovative product offerings, and potential for strategic acquisitions or partnerships.

Assessing the risk-reward profile involves comparing the potential returns (e.g., stock price appreciation) against the potential risks. Investors with a higher risk tolerance might find Ceridian more appealing given its growth potential, while more risk-averse investors might prefer less volatile alternatives.

FAQ Explained

What is Ceridian’s current market capitalization?

Ceridian’s market capitalization fluctuates constantly. To find the most up-to-date information, refer to a reputable financial website such as Yahoo Finance or Google Finance.

Where can I buy Ceridian stock?

Ceridian stock can be purchased through most major brokerage firms. Consult your broker for specific details on purchasing the stock.

How often does Ceridian release earnings reports?

Ceridian typically releases its earnings reports on a quarterly basis. The exact dates are announced in advance and are readily available on their investor relations website.

What is the dividend yield on Ceridian stock?

Whether Ceridian pays a dividend and the current yield will vary. Check a reliable financial resource for the most current information.