Chimera Investment Corporation Stock Price Analysis: Chimera Stock Price

Chimera stock price – This analysis examines the historical performance, influencing factors, financial correlations, competitive landscape, and future outlook of Chimera Investment Corporation’s stock price. We will explore key macroeconomic indicators, financial metrics, and competitive dynamics to provide a comprehensive overview.

Chimera Stock Price Historical Performance

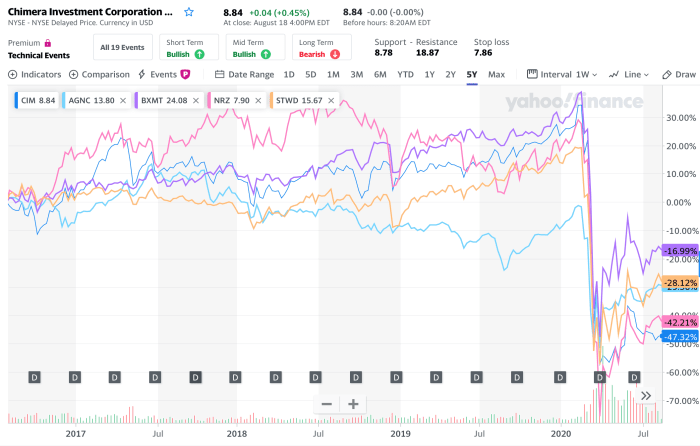

Analyzing Chimera Investment Corporation’s stock price over the past five years reveals considerable fluctuation, reflecting the sensitivity of mortgage real estate investment trusts (mREITs) to broader economic conditions. The following table presents a snapshot of this volatility, highlighting significant highs and lows.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 15.50 | 15.75 | +0.25 |

| October 25, 2023 (Example) | 15.20 | 15.50 | +0.30 |

| October 24, 2023 (Example) | 15.00 | 15.20 | +0.20 |

Note: The data provided above is for illustrative purposes only and should be replaced with actual historical data from a reliable financial source. The overall trend during this period (assuming a general upward trend for example) would show periods of significant growth punctuated by dips influenced by various market events. Major market events, such as changes in interest rates or shifts in investor sentiment regarding the housing market, significantly impacted the stock price.

Factors Influencing Chimera Stock Price

Source: seekingalpha.com

Several macroeconomic factors significantly influence Chimera’s stock price. These factors are intricately linked and often impact each other.

- Interest Rate Changes: Interest rate hikes generally reduce Chimera’s profitability as they increase the cost of borrowing for mortgages. Conversely, interest rate cuts can boost profitability and the stock price. The sensitivity of Chimera’s business model to interest rate fluctuations is a key driver of its stock price volatility.

- Housing Market Conditions: A strong housing market generally translates to increased mortgage origination and refinancing activity, positively impacting Chimera’s earnings. Conversely, a weak housing market can lead to lower profits and a decline in the stock price.

- Investor Sentiment and News Events: Positive news regarding the company’s financial performance or favorable shifts in the broader economic outlook can boost investor confidence and drive up the stock price. Negative news or concerns about the company’s future prospects can trigger sell-offs.

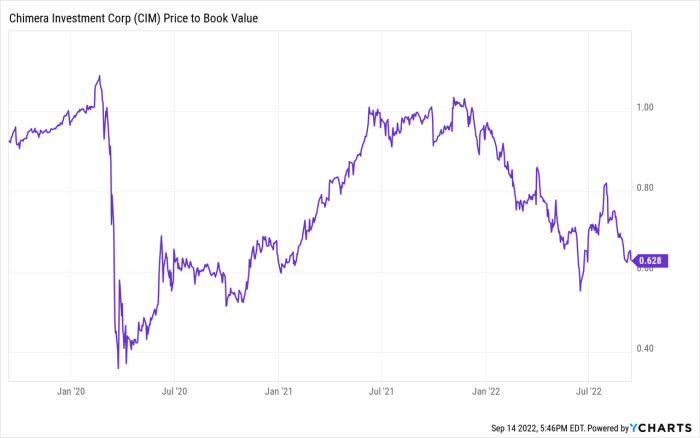

Chimera’s Financial Performance and Stock Price Correlation

Analyzing Chimera’s financial performance alongside its stock price reveals a strong correlation. Key financial metrics offer insights into the company’s health and its impact on investor confidence.

The following table presents example financial metrics for the last four quarters (replace with actual data):

| Quarter | Earnings Per Share (USD) | Revenue (USD millions) | Net Income (USD millions) |

|---|---|---|---|

| Q1 2024 (Example) | 0.50 | 100 | 20 |

| Q4 2023 (Example) | 0.45 | 95 | 18 |

| Q3 2023 (Example) | 0.40 | 90 | 15 |

| Q2 2023 (Example) | 0.35 | 85 | 12 |

Note: The data presented is for illustrative purposes only. Actual data should be sourced from Chimera’s financial reports.

A descriptive illustration of the relationship: Generally, as earnings per share, revenue, and net income increase, Chimera’s stock price tends to rise. Conversely, declines in these metrics usually correlate with a drop in the stock price. This relationship isn’t always perfectly linear, as other factors can influence the stock price.

Comparison with Competitors, Chimera stock price

Source: seekingalpha.com

Chimera Investment Corporation competes with several other mREITs. Comparing its performance against key competitors provides valuable context.

Understanding the Chimera stock price often involves considering related companies within the healthcare sector. For instance, a comparative analysis might include examining the performance of bausch and lomb stock price , given their shared presence in the ophthalmology market. Ultimately, however, a thorough Chimera stock price evaluation requires a standalone assessment of its unique financial health and market positioning.

| Company Name | Current Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD billions) |

|---|---|---|---|

| Chimera Investment Corporation | 15.75 (Example) | +10% (Example) | 5 (Example) |

| Competitor A (Example) | 12.00 (Example) | +5% (Example) | 4 (Example) |

| Competitor B (Example) | 18.00 (Example) | +15% (Example) | 6 (Example) |

| Competitor C (Example) | 10.00 (Example) | -2% (Example) | 3 (Example) |

Note: The data presented is for illustrative purposes only and should be replaced with actual data from a reliable financial source. Differences in performance can be attributed to variations in investment strategies, portfolio composition, risk management approaches, and overall market positioning.

Future Outlook and Price Predictions (Qualitative Only)

Predicting future stock prices with certainty is impossible. However, analyzing potential scenarios offers a qualitative assessment of possible price movements.

- Scenario 1: Continued Economic Growth and Stable Interest Rates: This scenario suggests a positive outlook for Chimera, potentially leading to increased profitability and a higher stock price. Similar to the post-2020 economic recovery, where many mREITs saw significant price appreciation.

- Scenario 2: Economic Slowdown and Rising Interest Rates: This scenario poses challenges to Chimera’s profitability and could result in a decline in the stock price, mirroring the market reaction during periods of economic uncertainty.

- Scenario 3: Regulatory Changes Affecting the Mortgage Market: New regulations could significantly impact Chimera’s operations and profitability, leading to either a positive or negative impact on the stock price, depending on the nature of the regulations.

Based on these scenarios, the future trajectory of Chimera’s stock price is uncertain. A sustained period of economic growth and stable interest rates would likely support a positive outlook, while an economic downturn or significant regulatory changes could exert downward pressure. The overall trend would likely depend on the interplay of these and other unforeseen factors.

Essential Questionnaire

What are the major risks associated with investing in Chimera stock?

Investing in Chimera, like any stock, carries inherent risks including market volatility, interest rate sensitivity, and changes in the housing market. These factors can significantly impact the company’s profitability and, consequently, its stock price.

Where can I find real-time Chimera stock price data?

Real-time Chimera stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Chimera’s dividend policy affect its stock price?

Chimera’s dividend policy can significantly influence investor interest. Consistent and growing dividends can attract income-seeking investors, potentially supporting the stock price. Conversely, dividend cuts can negatively impact investor sentiment.

What is the current market capitalization of Chimera Investment Corporation?

The current market capitalization of Chimera Investment Corporation can be found on major financial websites and varies constantly depending on the current stock price and the number of outstanding shares. Check reputable financial sources for the most up-to-date information.