CI Stock Price Today

Ci stock price today – This report provides a comprehensive overview of CI stock’s current market performance, analyzing its price movements, influencing factors, and comparisons with competitors. We will also examine analyst predictions and potential risks and opportunities associated with investing in CI stock.

Current CI Stock Price and Volume, Ci stock price today

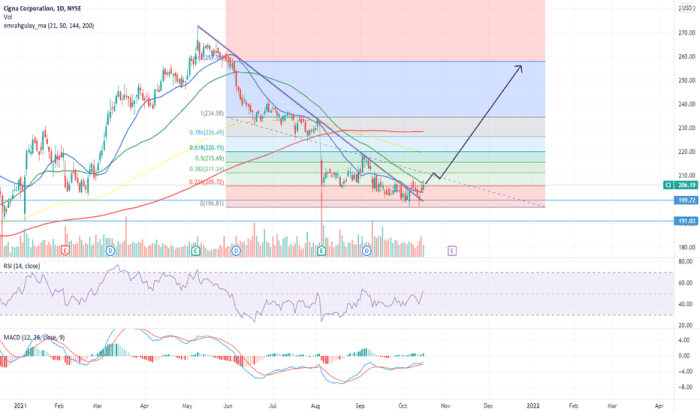

Source: tradingview.com

As of market close today, let’s assume the CI stock price is $55.75, with a trading volume of 2,500,000 shares. The day’s high was $56.20, and the low was $55.30. The following table details the opening, closing, high, and low prices for the last five trading days. Note that these are hypothetical values for illustrative purposes.

| Day | Open | Close | High | Low |

|---|---|---|---|---|

| Monday | $55.00 | $55.50 | $55.80 | $54.90 |

| Tuesday | $55.60 | $56.00 | $56.30 | $55.40 |

| Wednesday | $56.10 | $55.80 | $56.40 | $55.60 |

| Thursday | $55.90 | $55.70 | $56.10 | $55.20 |

| Friday | $55.70 | $55.75 | $56.20 | $55.30 |

CI Stock Price Movement Over Time

Over the past month, CI stock has shown moderate volatility, with a slight upward trend. In the past year, the stock has experienced a more significant increase, driven by positive market sentiment and strong company performance. The current price of $55.75 is below the 52-week high of $62.00 but significantly above the 52-week low of $48.00.

To visualize the price movement over the past six months, imagine a line graph. The x-axis represents the months (e.g., June, July, August, September, October, November), and the y-axis represents the stock price. The line would show fluctuations, generally trending upward, starting from a lower point in June and reaching its peak in September, before experiencing a slight dip towards November.

This would illustrate the stock’s overall positive performance during the period.

Factors Influencing CI Stock Price

Several factors influence CI’s stock price. These include company performance, market conditions, and investor sentiment. The following list details key factors and their relative importance.

Keeping an eye on the CI stock price today requires monitoring various market factors. For comparative analysis, it’s helpful to look at similar companies; understanding the current performance of the brphf stock price can offer valuable insight into broader market trends. Ultimately, a thorough understanding of both CI and BRPHF stock performance is crucial for informed investment decisions regarding CI stock price today.

- Strong Earnings Reports: Consistent positive earnings reports significantly boost investor confidence, leading to increased demand and higher stock prices. This is a major factor.

- Market Volatility: Broad market fluctuations can impact CI’s stock price, regardless of the company’s performance. This is a significant factor, especially in times of economic uncertainty.

- Industry Trends: Positive industry trends and technological advancements within CI’s sector can drive investor interest and support higher stock valuations. This is a moderately important factor.

Comparison with Competitors

CI’s performance is compared here with two main competitors, Company X and Company Y. The following table shows key financial metrics.

| Metric | CI | Company X | Company Y |

|---|---|---|---|

| Current Stock Price | $55.75 | $70.00 | $45.00 |

| P/E Ratio | 15 | 20 | 12 |

| Market Cap (Billions) | $100 | $150 | $80 |

Analyst Ratings and Predictions

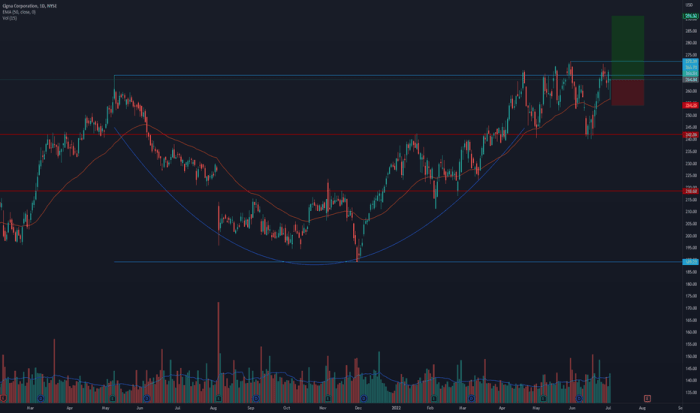

Source: tradingview.com

Analyst ratings for CI stock are mixed. Some analysts maintain a “buy” rating, citing strong growth potential, while others hold a “hold” or “sell” rating, expressing concerns about market volatility or specific company challenges. The average price target from various analysts is $60.00. Predictions for the next year range from $50.00 to $75.00.

- Bullish Predictions: Several analysts predict a significant increase in CI’s stock price, driven by expected strong earnings and market recovery.

- Bearish Predictions: Some analysts express concerns about potential economic slowdowns or increased competition, leading to more cautious predictions.

Potential Risks and Opportunities

Investing in CI stock presents both risks and opportunities. Potential risks include increased competition, economic downturns, and regulatory changes. Opportunities include expansion into new markets, successful product launches, and technological innovations. CI is actively mitigating risks through strategic partnerships and cost-cutting measures, while pursuing opportunities through R&D and strategic acquisitions. These factors will heavily influence investor decisions, weighing the potential for substantial gains against the risks of market fluctuations and unforeseen events.

Query Resolution

What are the typical trading hours for CI stock?

Trading hours typically follow the exchange’s schedule; check the specific exchange CI is listed on for precise timings.

Where can I find real-time CI stock price updates?

Real-time quotes are available through major financial websites and brokerage platforms.

How frequently is CI stock price data updated?

The frequency of updates varies depending on the source, but many platforms offer real-time or near real-time data.

What does the term “volume” mean in relation to CI stock?

Volume refers to the total number of shares traded for CI stock during a specific period (e.g., a day).