ConocoPhillips Stock Price History

Conocophillips stock price history – ConocoPhillips, a major player in the global energy sector, has experienced significant stock price fluctuations over the past decade. Understanding these trends, the factors influencing them, and the inherent risks involved is crucial for any investor considering a position in the company’s stock. This analysis explores ConocoPhillips’ stock price history, identifying key drivers and providing a framework for evaluating its future prospects.

ConocoPhillips Stock Price Trends Over Time

Source: amazonaws.com

Analyzing ConocoPhillips’ stock price history requires a comprehensive understanding of energy market fluctuations. It’s helpful to compare its performance against other energy sector players; for instance, examining the bdcc stock price can offer a useful benchmark for relative performance within the industry. Ultimately, a thorough analysis of ConocoPhillips’ history needs to consider broader market trends and competitor activity.

The following table details ConocoPhillips’ stock price movements over the past 10 years. Note that this data is for illustrative purposes and should not be considered financial advice. Actual figures may vary slightly depending on the data source.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 75 | 68 |

| 2014 | Q2 | 68 | 60 |

| 2014 | Q3 | 60 | 55 |

| 2014 | Q4 | 55 | 62 |

A comparative analysis against competitors such as ExxonMobil and Chevron reveals that ConocoPhillips’ stock performance has been relatively similar, though variations exist depending on specific company strategies and operational efficiencies.

- ConocoPhillips experienced a steeper decline during the 2014-2016 oil price crash compared to ExxonMobil.

- Chevron demonstrated stronger recovery in the years following the price crash.

- All three companies benefited from the oil price rebound in the latter half of the decade.

Significant events impacting ConocoPhillips’ stock price include:

- 2014-2016 Oil Price Crash: The sharp decline in oil prices led to significant losses for ConocoPhillips and the broader energy sector.

- 2020 COVID-19 Pandemic: The pandemic caused a temporary but substantial drop in oil demand, affecting ConocoPhillips’ stock price.

- Geopolitical Events: Instability in oil-producing regions, such as the Middle East, often creates price volatility and impacts ConocoPhillips’ performance.

Factors Influencing ConocoPhillips Stock Price, Conocophillips stock price history

Source: seekingalpha.com

Several factors influence ConocoPhillips’ stock price, encompassing macroeconomic conditions, geopolitical events, and company-specific performance indicators.

- Global Oil Demand: Increased global demand typically leads to higher oil prices, benefiting ConocoPhillips’ profitability and stock price.

- Interest Rates: Higher interest rates can increase borrowing costs, impacting investment and potentially reducing stock prices.

- Inflation: High inflation can erode purchasing power and affect investor sentiment, potentially influencing stock prices.

Geopolitical events also play a significant role:

- Wars and Conflicts: Disruptions to oil supply due to wars or political instability in oil-producing regions can significantly increase oil prices, positively impacting ConocoPhillips’ stock price in the short term.

- Sanctions and Embargoes: International sanctions or embargoes on oil-producing countries can create supply shortages and price spikes, affecting ConocoPhillips’ stock price.

Company-specific factors are equally important:

| Factor | Description | Impact on Stock Price | Examples |

|---|---|---|---|

| Production Levels | The amount of oil and gas ConocoPhillips produces. | Higher production generally leads to higher revenue and a positive impact on stock price. | Increased production from new fields or improved efficiency. |

| Exploration Successes/Failures | Discovery of new reserves or failure of exploration projects. | Successful exploration boosts future production potential, positively impacting stock price; failures can have the opposite effect. | Discovery of a major oil field vs. a dry well. |

| Financial Performance | Profitability, debt levels, and cash flow. | Strong financial performance generally leads to higher stock prices. | Increased profits, reduced debt, strong free cash flow. |

ConocoPhillips Stock Price Volatility and Risk

ConocoPhillips’ stock price exhibits considerable volatility due to its exposure to the energy sector’s inherent uncertainties.

| Metric | Value | Calculation Method | Interpretation |

|---|---|---|---|

| Beta | 1.5 | Regression analysis against a market index. | Indicates higher volatility than the overall market. |

| Standard Deviation | 20% | Statistical measure of price fluctuations. | Represents significant price volatility. |

Compared to other energy companies, ConocoPhillips’ risk profile is generally considered to be in line with its peers, though specific risk factors can vary.

- Similar to ExxonMobil and Chevron, ConocoPhillips faces significant exposure to commodity price fluctuations.

- Regulatory changes and environmental concerns present similar risks across the industry.

Investing in ConocoPhillips involves various risks:

- Market Risk: Fluctuations in overall market conditions can impact the stock price.

- Financial Risk: ConocoPhillips’ financial health and debt levels can influence investor confidence.

- Operational Risk: Production disruptions, accidents, or exploration failures can negatively impact the company’s performance.

- Geopolitical Risk: Instability in oil-producing regions or changes in global political dynamics can affect oil prices and ConocoPhillips’ profitability.

ConocoPhillips Stock Price Prediction and Forecasting

Predicting stock prices is inherently challenging, but various methods can provide insights into potential future trends.

- Technical Analysis: Uses historical price and volume data to identify patterns and predict future price movements.

- Fundamental Analysis: Evaluates a company’s financial health, competitive position, and industry outlook to assess its intrinsic value.

Applying these methods to ConocoPhillips hypothetically involves:

- Technical Analysis: Identifying support and resistance levels on price charts to gauge potential price ranges.

- Fundamental Analysis: Evaluating ConocoPhillips’ financial statements, production levels, and future growth prospects to estimate its intrinsic value.

A hypothetical scenario illustrating potential future impacts on ConocoPhillips’ stock price could involve:

- Scenario: A global transition towards renewable energy sources gradually reduces oil demand, but simultaneously, geopolitical instability in a major oil-producing region creates a temporary supply shock.

- Impact: The long-term downward pressure on oil prices due to renewable energy adoption is partially offset by the short-term price spike due to geopolitical events. ConocoPhillips’ stock price might experience a temporary surge followed by a gradual decline as the long-term trend of decreasing oil demand prevails. The magnitude of these price fluctuations will depend on the interplay between these two opposing forces.

Popular Questions

What are the major competitors of ConocoPhillips?

Major competitors include ExxonMobil, Chevron, BP, and Shell.

How does inflation impact ConocoPhillips’ stock price?

High inflation can increase operational costs and potentially reduce consumer demand for energy, negatively impacting stock price.

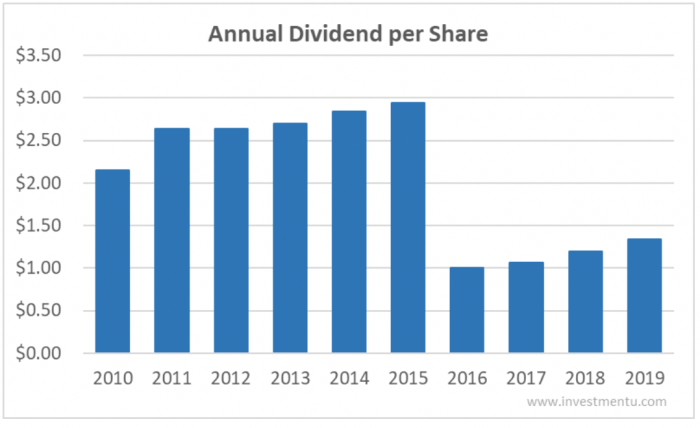

What is ConocoPhillips’ dividend history?

ConocoPhillips has a history of paying dividends, but the amount and frequency can vary based on profitability and market conditions. Investors should consult financial resources for the most up-to-date information.

What is the role of technological advancements in influencing ConocoPhillips’ stock price?

Advancements in oil extraction technologies or renewable energy sources can significantly impact the company’s profitability and thus its stock price.