Nike’s Current Stock Price

Current nike stock price – Nike, a global leader in athletic footwear and apparel, experiences consistent stock price fluctuations influenced by various economic, competitive, and brand-related factors. This analysis examines Nike’s current stock price, exploring key factors impacting its value and providing insights into future projections.

Current Nike Stock Price Overview

Nike’s stock price, like any publicly traded company, is subject to daily volatility. To provide a comprehensive overview, we will examine recent price movements across different timeframes. While specific real-time data is constantly changing, we can illustrate typical fluctuations using hypothetical examples for clarity. Assume, for instance, that on a particular day, Nike’s stock opened at $150, reached a high of $155, experienced a low of $148, and closed at $152.

This illustrates a typical day’s trading range. Analyzing price changes over a week, month, and year provides a broader perspective on overall trends.

| Open | High | Low | Close |

|---|---|---|---|

| $150 | $155 | $148 | $152 |

Factors Influencing Nike’s Stock Price

Several key factors significantly influence Nike’s stock price. These include macroeconomic conditions, consumer spending patterns, and competitive dynamics within the sportswear industry.

- Economic Factors: Inflation, interest rates, and overall economic growth directly impact consumer spending, influencing demand for Nike’s products. High inflation can reduce disposable income, potentially lowering demand. Similarly, rising interest rates can increase borrowing costs for consumers and businesses.

- Consumer Spending Habits: Shifts in consumer preferences towards athletic apparel and footwear, influenced by trends and fashion cycles, directly impact Nike’s sales and profitability. A strong preference for sustainable and ethically sourced products also plays a significant role.

- Competitor Actions: The actions of competitors, such as Adidas, Under Armour, and Puma, significantly impact Nike’s market share and stock valuation. Innovative product launches, aggressive marketing campaigns, and strategic partnerships by competitors can affect investor confidence in Nike’s future performance.

Nike’s Financial Performance and Stock Price

Nike’s financial performance, as reflected in its quarterly and annual earnings reports, significantly influences its stock price. Revenue growth, profitability, and earnings per share (EPS) are crucial metrics that investors closely monitor. Positive financial results generally lead to increased investor confidence and higher stock prices, while disappointing results can cause the opposite effect.

| Metric | Q1 2024 (Hypothetical) | Q2 2024 (Hypothetical) | Q3 2024 (Hypothetical) |

|---|---|---|---|

| Revenue (USD Billions) | 12 | 13 | 14 |

| Earnings Per Share (USD) | 1.00 | 1.10 | 1.20 |

Nike’s Brand and Stock Price, Current nike stock price

Source: trading-education.com

Nike’s strong brand image and reputation are integral to its stock value. Positive brand perception fosters consumer loyalty and drives sales, influencing investor confidence. Successful marketing campaigns further reinforce the brand’s image, impacting stock price positively.

- Brand Image: Nike’s association with athletic achievement and innovation contributes significantly to its brand equity and influences investor perception.

- Marketing Campaigns: Effective marketing campaigns, such as those featuring high-profile athletes, enhance brand visibility and appeal, positively impacting stock price.

- Brand Loyalty: Strong brand loyalty creates a stable customer base, contributing to long-term stock stability and predictability of future earnings.

Analyst Predictions and Stock Price

Source: businessinsider.com

Financial analysts regularly provide ratings and price targets for Nike’s stock, offering various perspectives on its future performance. These predictions are based on thorough analysis of Nike’s financial statements, market trends, and competitive landscape. While these predictions are not guarantees, they offer valuable insights into market sentiment and potential future stock price movements.

- Analyst A: Positive outlook; predicts a price target of $175 based on strong brand loyalty and expected revenue growth.

- Analyst B: Neutral outlook; predicts a price target of $160, citing potential challenges from increased competition and economic uncertainty.

- Analyst C: Cautious outlook; predicts a price target of $155 due to concerns about slowing consumer spending and supply chain disruptions.

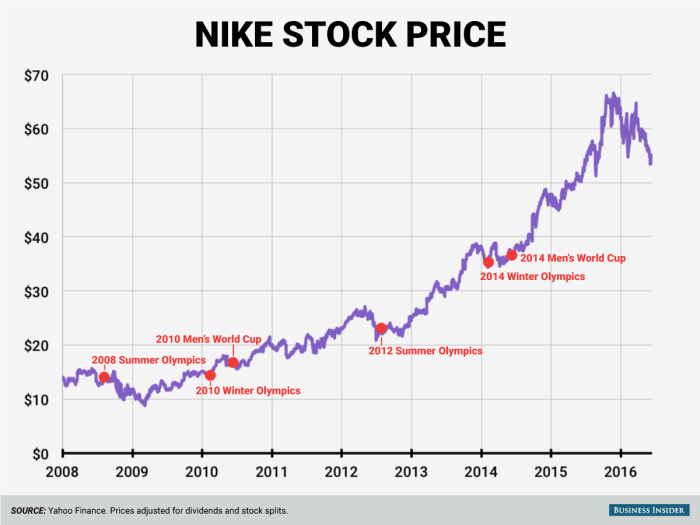

Illustrative Example: Impact of a Major Sporting Event

Major sporting events like the Olympics significantly impact Nike’s stock price. If Nike sponsors a large number of athletes who perform exceptionally well, and the associated marketing campaigns are successful, investor confidence could increase, leading to a short-term stock price surge. However, a poor performance by sponsored athletes or negative publicity surrounding the event could have a negative impact.

Long-term effects depend on the sustained impact of the event on brand perception and sales.

Monitoring the current Nike stock price requires a keen eye on market trends. It’s interesting to compare its performance against other major players in different sectors; for instance, understanding the trajectory of the burlington northern santa fe stock price provides a contrasting perspective on the current economic climate. Ultimately, both illustrate the complexities of the stock market and the various factors impacting investment choices.

For example, a hypothetical scenario where a sponsored athlete wins multiple gold medals and Nike’s marketing effectively leverages this success could lead to a 5-10% increase in stock price in the short term. Conversely, if the event is marred by controversy or a key sponsored athlete underperforms, the stock might experience a temporary dip. The long-term impact will depend on how effectively Nike manages the event’s aftermath and maintains its brand image.

FAQ Overview: Current Nike Stock Price

What are the main risks associated with investing in Nike stock?

Investing in any stock carries inherent risk. For Nike, potential risks include competition from other brands, changing consumer preferences, economic downturns impacting consumer spending, and supply chain disruptions.

Where can I find real-time Nike stock price data?

Real-time Nike stock price data is readily available through major financial websites and stock trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does Nike’s sustainability initiatives affect its stock price?

Increasingly, investors consider environmental, social, and governance (ESG) factors. Nike’s commitment to sustainability can positively influence investor sentiment and potentially boost its stock price, particularly among ethically conscious investors.

What is Nike’s dividend policy?

Nike’s dividend policy should be checked on their investor relations page or through financial news sources. Dividend payouts can influence investor decisions and stock price.