Bank of America Stock Price: A Comprehensive Overview: Current Price Of Bank Of America Stock

Current price of bank of america stock – This article provides a detailed analysis of Bank of America’s current stock price, considering various factors influencing its value, historical performance, analyst predictions, and investment considerations. We will explore data sources, macroeconomic impacts, regulatory influences, and provide insights for potential investors.

Current Bank of America Stock Price: Data Sources

Reliable and accurate data is crucial for informed investment decisions. Several reputable sources provide real-time and historical Bank of America stock prices. The following table compares some key sources, considering data presentation and reliability.

| Ticker Symbol | Source Name | URL | Data Reliability Rating (1-5, 5 being highest) |

|---|---|---|---|

| BAC | Yahoo Finance | finance.yahoo.com | 4 |

| BAC | Google Finance | google.com/finance | 4 |

| BAC | Bloomberg | bloomberg.com | 5 |

| BAC | MarketWatch | marketwatch.com | 4 |

| BAC | Nasdaq | nasdaq.com | 5 |

Comparing Yahoo Finance, Google Finance, and Bloomberg, we observe differences in data presentation. Yahoo Finance offers a clean, straightforward interface, ideal for quick price checks. Google Finance provides a similar experience with additional charting tools. Bloomberg, catering to professional investors, offers more in-depth data, including real-time quotes, news, and analytical tools. However, its interface can be overwhelming for casual users.

Discrepancies between sources can arise due to slight delays in data updates, different methodologies for calculating metrics, and the sheer volume of trades occurring simultaneously.

Factors Influencing Bank of America’s Stock Price

Source: googleapis.com

Several macroeconomic factors, interest rate changes, and regulatory shifts significantly influence Bank of America’s stock price.

Three significant macroeconomic factors impacting Bank of America’s stock price are economic growth, inflation, and unemployment. Strong economic growth generally leads to increased lending activity and higher profits for banks, boosting their stock prices. Conversely, high inflation erodes purchasing power and can slow down economic activity, negatively affecting bank profitability. High unemployment reduces consumer spending and loan demand, also impacting bank performance.

Interest rate changes directly affect Bank of America’s profitability. Higher interest rates increase the net interest margin, improving profitability and potentially boosting the stock price. Conversely, lower interest rates can squeeze margins and negatively impact stock valuation. Major regulatory changes, such as those related to capital requirements or lending practices, can significantly impact the banking sector. Increased regulatory scrutiny might increase compliance costs and limit lending opportunities, potentially reducing profitability and impacting stock prices.

Historical Performance of Bank of America Stock

Understanding Bank of America’s past performance provides valuable context for future investment decisions.

- 2008-2009 Financial Crisis: The crisis severely impacted Bank of America, leading to a significant drop in its stock price due to substantial losses and government bailouts.

- 2010-2012 Recovery and Restructuring: Bank of America underwent restructuring and recovery efforts, leading to gradual stock price improvement.

- 2015-2019 Steady Growth: The bank experienced a period of steady growth, with its stock price reflecting improved financial health and profitability.

- 2020-Present Pandemic and Recovery: The COVID-19 pandemic initially caused volatility, but subsequent economic recovery and government stimulus measures led to stock price fluctuations.

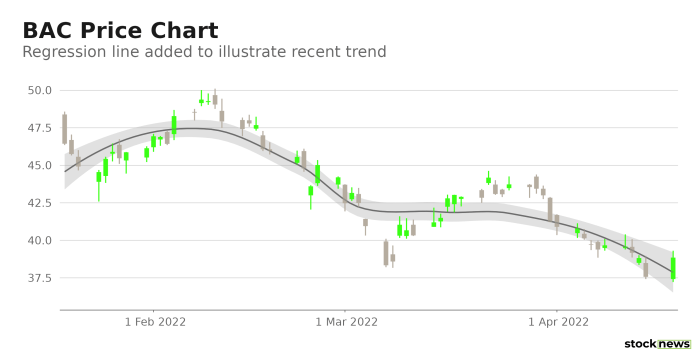

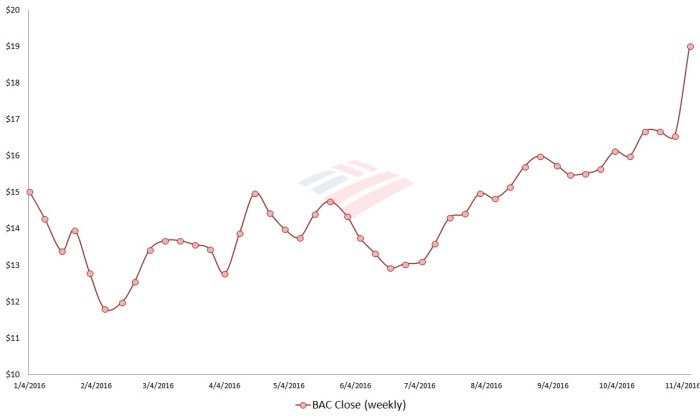

A line graph illustrating Bank of America’s stock price performance over the past five years would show the price on the y-axis and the date (in years) on the x-axis. Data points would represent the closing price for each month or quarter. The graph would likely show periods of both growth and decline, reflecting the influence of various economic and company-specific factors.

For instance, a significant drop might correspond to the initial impact of the pandemic, while subsequent recovery would be represented by an upward trend.

Comparing Bank of America’s stock performance to two major competitors (e.g., JPMorgan Chase and Citigroup) over the past three years requires a table showing the closing price for each company on selected dates (e.g., end of each quarter). This would allow for a direct comparison of performance and relative volatility.

| Date | Bank of America Price | JPMorgan Chase Price | Citigroup Price |

|---|---|---|---|

| Dec 31, 2020 | Example Price | Example Price | Example Price |

| Mar 31, 2021 | Example Price | Example Price | Example Price |

| Jun 30, 2021 | Example Price | Example Price | Example Price |

Analyst Ratings and Predictions for Bank of America Stock

Source: investorplace.com

Analyst opinions provide valuable insights into the potential future performance of Bank of America’s stock.

- Analyst Firm A: Buy rating, with a target price of $X.

- Analyst Firm B: Hold rating, with a target price of $Y.

- Analyst Firm C: Buy rating, with a target price of $Z.

The variation in price targets ($X, $Y, $Z) reflects differing views on Bank of America’s future growth prospects, risk tolerance, and the overall economic outlook. For example, a higher target price might reflect an analyst’s belief in strong future earnings growth, while a lower target price might reflect concerns about increased competition or regulatory risks. Analysts might identify opportunities such as increased lending activity in a recovering economy or expansion into new financial technologies.

Risks could include potential economic downturns, stricter regulatory environments, or increased competition from fintech companies. These factors directly influence their price predictions and overall ratings.

Investing in Bank of America Stock: Considerations, Current price of bank of america stock

Investing in Bank of America stock involves various methods and considerations.

Determining the current price of Bank of America stock involves checking reputable financial websites. Investors often compare it to other stocks in similar sectors; for instance, understanding the performance of related companies is helpful. A quick check of the chemours stock price today might provide a benchmark for comparison, helping investors assess Bank of America’s relative value within the broader market.

Ultimately, the Bank of America stock price depends on various market factors.

Investors can buy and sell Bank of America stock through brokerage accounts offered by various online platforms or traditional financial institutions. The risks associated with investing include market volatility, potential declines in Bank of America’s profitability, and changes in the overall economic climate. Rewards include potential capital appreciation if the stock price rises and the possibility of receiving dividends if the company chooses to distribute them.

To illustrate potential returns, consider a scenario where an investor buys 100 shares at $30 and sells them at $35. The profit would be ($35-$30)*100 = $500, representing a return of 16.7%. Conversely, selling at $25 would result in a loss of $500, a -16.7% return. These calculations highlight the inherent volatility and risk involved in stock market investments.

Clarifying Questions

What are the typical trading hours for Bank of America stock?

Bank of America stock (BAC) trades on the New York Stock Exchange (NYSE) during regular US market hours, typically 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

Where can I find Bank of America’s dividend history?

Bank of America’s dividend history can be found on their investor relations website, major financial news sources, and many brokerage platforms. Look for sections on “Dividends” or “Shareholder Information.”

How frequently does Bank of America release earnings reports?

Bank of America typically releases its quarterly earnings reports on a regular schedule, usually a few weeks after the end of each fiscal quarter. The exact dates are announced in advance and widely publicized.

What is the difference between buying Bank of America stock and buying Bank of America bonds?

Buying Bank of America stock makes you a shareholder, owning a small portion of the company and entitled to potential dividends and capital appreciation. Buying Bank of America bonds makes you a creditor, lending money to the company and receiving interest payments.