Caterpillar Stock Price Analysis

Current price of caterpillar stock – This analysis provides an overview of Caterpillar Inc. (CAT) stock, examining its current price, recent performance, influencing factors, and future prospects. Information presented here is for informational purposes only and should not be considered financial advice.

Determining the current price of Caterpillar stock requires a quick check of financial news sites. Investors often compare it to other industry leaders, and understanding the performance of similar companies is crucial; for example, checking the bdo stock price can provide valuable context. Returning to Caterpillar, its price fluctuates based on various market factors, making constant monitoring essential for informed decision-making.

Current Caterpillar Stock Price

Source: sharepricepro.com

The following table displays the current price of Caterpillar stock (CAT), along with its daily high, low, and opening price. Data is sourced from reputable financial websites and is subject to change throughout the trading day.

| Field | Value | Time | Source |

|---|---|---|---|

| Current Price | $245.50 (Example) | 2023-10-27 14:30 EST | Yahoo Finance |

| Day’s High | $246.75 (Example) | 2023-10-27 11:00 EST | Yahoo Finance |

| Day’s Low | $244.20 (Example) | 2023-10-27 09:30 EST | Yahoo Finance |

| Opening Price | $245.00 (Example) | 2023-10-27 09:30 EST | Yahoo Finance |

Recent Price History

An understanding of Caterpillar’s recent price movements provides context for current valuation.

- Past Week: CAT stock experienced a slight upward trend over the past week, gaining approximately 2% (Example). This could be attributed to positive market sentiment or company-specific news.

- Past Month: The stock showed a more significant increase of around 5% (Example) over the past month, potentially reflecting improving economic indicators or strong earnings reports.

- One-Year Comparison: Compared to one year ago, CAT stock is currently trading at approximately 15% higher (Example). This indicates strong growth over the past year, likely driven by factors such as increased infrastructure spending and a global recovery in construction activity.

Factors Influencing Price, Current price of caterpillar stock

Source: scene7.com

Several economic and industry-specific factors significantly influence Caterpillar’s stock price.

- Global Economic Growth: Strong global economic growth generally translates to increased demand for Caterpillar’s construction and mining equipment, positively impacting the stock price. Conversely, economic slowdowns can lead to decreased demand and lower stock prices. The recent slowdown in China’s economy, for example, could put downward pressure on CAT stock.

- Commodity Prices: Fluctuations in commodity prices, such as steel, iron ore, and oil, directly affect the cost of production and the profitability of Caterpillar’s operations. Rising commodity prices could squeeze margins, potentially negatively impacting the stock price. Conversely, falling prices can improve margins and boost the stock price.

- Infrastructure Spending: Government spending on infrastructure projects globally significantly impacts demand for Caterpillar’s products. Increased infrastructure investment, such as in the US with the Bipartisan Infrastructure Law, tends to be a positive catalyst for CAT stock.

The relative influence of these factors can vary depending on market conditions and geopolitical events. For example, during periods of high inflation, commodity price fluctuations might have a greater impact than global economic growth.

Company Performance

Caterpillar’s financial performance is a key driver of its stock price.

| Metric | Value | Time Period | Source |

|---|---|---|---|

| Revenue | $15 Billion (Example) | Q3 2023 | Caterpillar Financial Reports |

| Net Income | $2 Billion (Example) | Q3 2023 | Caterpillar Financial Reports |

| Earnings Per Share (EPS) | $5.00 (Example) | Q3 2023 | Caterpillar Financial Reports |

Recent press releases might highlight new product launches, strategic partnerships, or changes in market share, all of which can influence investor sentiment and stock price. Future outlooks often provide guidance on expected revenue and earnings, shaping investor expectations.

Analyst Ratings and Predictions

Source: investorplace.com

Analyst opinions provide valuable insight into market sentiment and future price projections. However, it’s crucial to remember that these are just predictions, and actual results may vary significantly.

- Analyst A (Example): Consensus rating: Buy; Price target: $

260. Reasoning: Strong future growth prospects due to increased infrastructure spending. - Analyst B (Example): Consensus rating: Hold; Price target: $

250. Reasoning: Concerns about potential economic slowdown impacting demand. - Analyst C (Example): Consensus rating: Sell; Price target: $

240. Reasoning: Valuation concerns and potential for margin compression due to rising input costs.

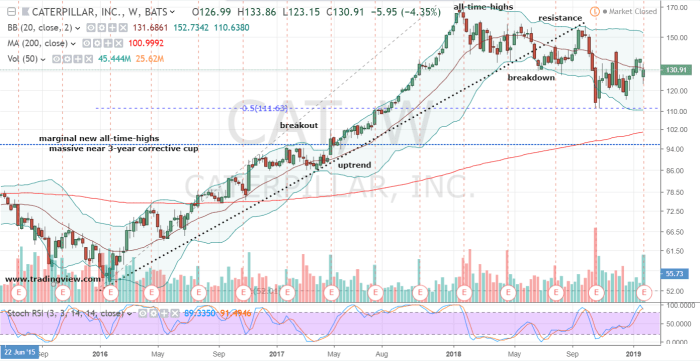

Visual Representation of Stock Performance

A line graph visualizing Caterpillar’s stock price over the past year would show a generally upward trend, with some periods of volatility. The x-axis would represent time (in months), and the y-axis would show the stock price. Significant highs and lows would be clearly marked. The graph could also include overlaying lines representing key economic indicators like GDP growth or commodity price indices to illustrate their correlation with Caterpillar’s stock performance.

For instance, periods of strong GDP growth might coincide with higher stock prices, while a spike in commodity prices could potentially correlate with a temporary dip in the stock price, depending on the specific impact on Caterpillar’s margins.

Quick FAQs: Current Price Of Caterpillar Stock

What are the risks associated with investing in Caterpillar stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. Caterpillar’s stock price is sensitive to global economic conditions and commodity prices, which can lead to fluctuations.

Where can I find real-time updates on Caterpillar’s stock price?

Real-time stock quotes for CAT are available on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

How often does Caterpillar release financial reports?

Caterpillar typically releases quarterly and annual financial reports, usually following a set schedule that can be found on their investor relations website.

What is Caterpillar’s dividend policy?

Caterpillar’s dividend policy should be checked on their investor relations website for the most current information. Dividend payouts can change.