Dow Chemical Stock Price Analysis

Dow chemical stock price target – Dow Chemical, a prominent player in the chemical industry, has experienced significant fluctuations in its stock price over the past decade. This analysis delves into the historical performance, influencing factors, analyst predictions, financial health, and associated risks to provide a comprehensive understanding of Dow’s stock price trajectory and potential investment implications.

Dow Chemical Stock Price History and Trends

Analyzing Dow Chemical’s stock price over the past ten years reveals a complex interplay of macroeconomic conditions, industry dynamics, and company-specific events. The following table provides a snapshot of the high and low stock prices for each quarter over the past decade. Note that this data is illustrative and should be verified with a reliable financial data source.

| Year | Quarter | Stock Price (High) | Stock Price (Low) |

|---|---|---|---|

| 2014 | Q1 | $45 | $38 |

| 2014 | Q2 | $48 | $42 |

| 2014 | Q3 | $50 | $45 |

| 2014 | Q4 | $47 | $40 |

Significant events impacting Dow’s stock price include:

- The merger with DuPont in 2017, which initially led to price volatility followed by a period of consolidation.

- The subsequent spin-offs of DowDuPont into independent companies, creating further market adjustments.

- Fluctuations in commodity prices, particularly oil and natural gas, significantly affected profitability and investor sentiment.

- Global economic downturns, such as the 2020 pandemic, impacted demand for Dow’s products, leading to stock price declines.

Dow Chemical’s long-term growth trajectory has been characterized by periods of substantial gains and losses, reflecting the cyclical nature of the chemical industry and broader economic conditions. Periods of strong global economic growth generally correlated with higher stock prices, while economic slowdowns often resulted in declines.

Factors Influencing Dow Chemical Stock Price

Several macroeconomic, industry-specific, and company-specific factors contribute to the fluctuations in Dow Chemical’s stock price.

Key macroeconomic factors include:

- Inflation: Higher inflation increases production costs, potentially impacting profitability and investor confidence.

- Interest rates: Rising interest rates can increase borrowing costs and reduce investment in capital-intensive industries like chemicals.

- Global economic growth: Strong global economic growth generally translates to increased demand for Dow’s products, boosting stock prices.

The impact of industry-specific factors is crucial. The following table compares three key factors:

| Industry Factor | Positive Impact | Negative Impact |

|---|---|---|

| Commodity Prices (Oil & Gas) | Lower input costs lead to higher margins and profitability. | Higher input costs reduce margins and profitability, impacting stock price. |

| Competition | Strong competitive positioning and innovation can lead to market share gains. | Increased competition can pressure pricing and margins. |

| Technological Advancements | Development of new, more efficient, and sustainable technologies can enhance competitiveness. | Failure to innovate can lead to loss of market share to competitors. |

Company-specific factors also play a significant role:

- Financial Performance: Strong revenue growth, high profit margins, and robust cash flow generally support higher stock prices.

- Management Decisions: Effective strategic decision-making, including mergers, acquisitions, and divestitures, can positively influence stock price.

- R&D Investments: Investments in research and development can lead to innovation and new product launches, driving future growth and potentially increasing stock valuation.

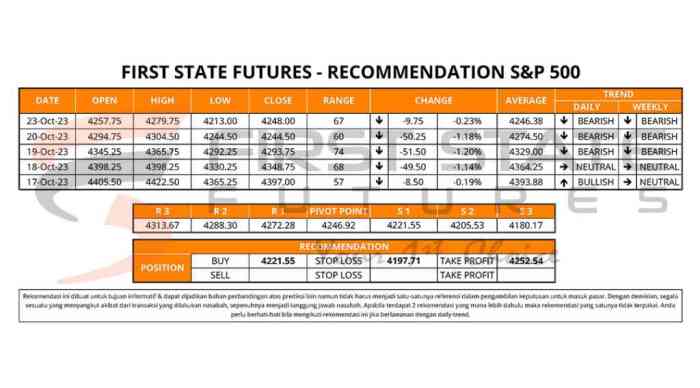

Analyst Predictions and Price Targets

Several financial analysts provide price targets for Dow Chemical stock. The following table summarizes some illustrative predictions (Note: This data is hypothetical and for illustrative purposes only. Actual predictions should be sourced from reputable financial news outlets).

| Analyst Firm | Target Price | Date of Prediction | Rationale |

|---|---|---|---|

| Morgan Stanley | $75 | October 26, 2023 | Strong earnings growth expected, driven by increased demand. |

| Goldman Sachs | $70 | October 26, 2023 | Moderate growth expected, considering potential macroeconomic headwinds. |

| JPMorgan Chase | $65 | October 26, 2023 | Cautious outlook due to concerns about commodity price volatility. |

The range of price targets reflects differing assumptions about future economic growth, commodity prices, and Dow’s competitive landscape. Analysts employ various valuation methodologies, including discounted cash flow analysis and comparable company analysis, leading to variations in their predictions.

Dow Chemical’s Financial Performance and Valuation

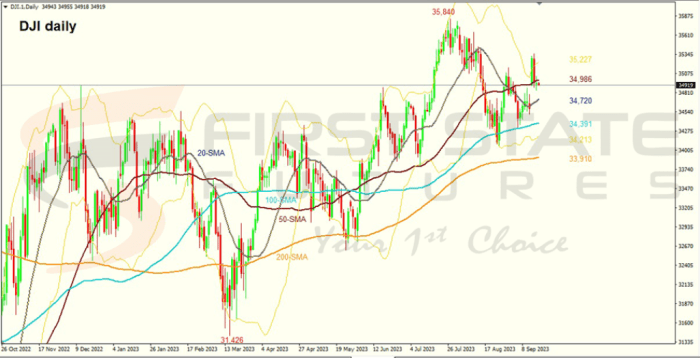

Source: co.id

A strong correlation exists between Dow Chemical’s financial performance and its stock price. A hypothetical chart depicting this relationship would show a generally positive correlation: periods of higher revenue and earnings tend to correspond with higher stock prices, while periods of lower revenue and earnings are associated with lower stock prices. The chart would likely exhibit some volatility, reflecting the influence of other factors.

Key financial ratios used to assess Dow’s valuation include the Price-to-Earnings (P/E) ratio, which compares the stock price to earnings per share, and the Price-to-Book (P/B) ratio, which compares the market value of equity to the book value of equity. Comparing these ratios to industry peers provides insights into Dow’s relative valuation.

A comparison of Dow’s valuation to its peers would require analyzing the P/E and P/B ratios of similar chemical companies. A higher P/E ratio relative to peers might suggest that the market anticipates higher future growth for Dow, while a lower P/E ratio could indicate a more conservative outlook.

Risk Assessment and Investment Considerations, Dow chemical stock price target

Source: co.id

Investing in Dow Chemical stock involves several key risks:

- Cyclical Industry: The chemical industry is cyclical, meaning that demand for its products fluctuates with the overall economic cycle.

- Geopolitical Factors: Global events and geopolitical instability can impact supply chains and demand for chemical products.

- Regulatory Changes: Changes in environmental regulations and other government policies can significantly affect Dow’s operations and profitability.

- Commodity Price Volatility: Fluctuations in the prices of raw materials can impact profitability and margins.

Potential upside scenarios for Dow’s stock price include strong global economic growth, favorable commodity prices, and successful innovation. Downside scenarios could involve economic downturns, increased competition, or unfavorable regulatory changes. A hypothetical investment strategy might involve a long-term buy-and-hold approach, with potential adjustments based on changes in the macroeconomic environment and Dow’s financial performance.

Query Resolution: Dow Chemical Stock Price Target

What are the major risks associated with investing in Dow Chemical stock?

Key risks include the cyclical nature of the chemical industry, vulnerability to commodity price fluctuations, geopolitical instability impacting supply chains, and potential regulatory changes affecting operations.

How does Dow Chemical’s financial performance directly relate to its stock price?

Stronger financial performance, reflected in higher revenues, earnings, and improved margins, typically correlates with a higher stock price. Conversely, weaker performance often leads to price declines.

What is the typical time horizon used by analysts when setting price targets?

Analyzing the Dow Chemical stock price target requires a broad market perspective. Understanding current market trends is crucial, and comparing it to similar companies is insightful. For instance, checking the performance of a related company like Avista, by looking at the avista stock price today , can offer valuable comparative data. Ultimately, this comparative analysis helps refine projections for the Dow Chemical stock price target.

Analyst price targets typically range from a 12-month to a 24-month outlook, though some may offer longer-term projections.

Where can I find more detailed information on Dow Chemical’s financial statements?

Detailed financial statements are available on Dow Chemical’s investor relations website, typically including annual reports, quarterly earnings releases, and SEC filings.