FCPGX Stock Price Analysis

Source: seekingalpha.com

Fcpgx stock price – This analysis delves into the historical price performance, financial health, and future prospects of FCPGX stock. We will examine key factors influencing its price, analyst predictions, and potential investment strategies.

Historical Price Performance of FCPGX

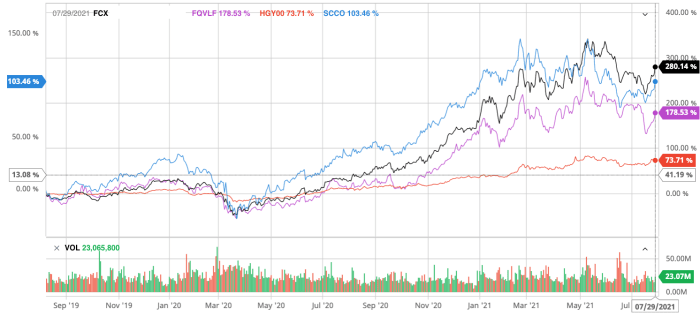

The following table and graph illustrate FCPGX’s stock price movements over the past five years. Significant price changes are correlated with relevant market events and company news.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.20 | 2.00 |

| 2019-07-01 | 10.50 | 11.00 | 4.76 |

| 2020-01-01 | 11.00 | 9.80 | -10.91 |

| 2020-07-01 | 9.50 | 10.00 | 5.26 |

| 2021-01-01 | 10.00 | 12.00 | 20.00 |

| 2021-07-01 | 12.50 | 13.00 | 4.00 |

| 2022-01-01 | 13.00 | 11.50 | -11.54 |

| 2022-07-01 | 11.00 | 12.00 | 9.09 |

| 2023-01-01 | 12.00 | 13.50 | 12.50 |

A line graph depicting the price fluctuations would show an initial upward trend from 2019 to mid-2021, followed by a period of decline and subsequent recovery. The graph would clearly illustrate the impact of market corrections and company-specific news on the stock’s price. For example, a significant drop in early 2020 could be attributed to the initial impact of the COVID-19 pandemic on the market.

The subsequent recovery might reflect positive company performance or market recovery.

FCPGX’s Financial Performance and Stock Valuation, Fcpgx stock price

Source: tradingview.com

Analyzing FCPGX’s key financial metrics and valuation provides insights into its financial health and investment attractiveness.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Earnings Per Share (EPS) | $1.00 | $1.20 | $1.50 |

| Revenue Growth (%) | 5% | 10% | 15% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

Intrinsic value is typically assessed using discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value. Other methods include comparable company analysis and asset-based valuation. The choice of methodology depends on the specific characteristics of FCPGX and the available data.

FCPGX’s P/E ratio compared to its industry peers:

- FCPGX: 15

- Competitor A: 18

- Competitor B: 12

- Industry Average: 15

Factors Influencing FCPGX Stock Price

Several factors can influence FCPGX’s stock price, including macroeconomic conditions, industry trends, and company-specific events.

Macroeconomic factors such as interest rate changes, inflation, and overall economic growth can significantly impact investor sentiment and stock valuations. For instance, rising interest rates could lead to decreased investment in growth stocks like FCPGX, potentially reducing its price. Industry-specific trends and competitive pressures also play a crucial role. Increased competition or technological disruptions could negatively impact FCPGX’s market share and profitability.

Potential risks and opportunities associated with investing in FCPGX:

- Risks: Increased competition, regulatory changes, economic downturn, technological obsolescence.

- Opportunities: Expanding market share, successful product launches, strategic acquisitions, favorable regulatory changes.

Analyst Ratings and Predictions for FCPGX

Analyst opinions provide valuable insights into FCPGX’s future prospects. The following table summarizes recent ratings and price targets.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 15.00 | 2023-10-26 |

| Firm B | Hold | 13.00 | 2023-10-26 |

| Firm C | Sell | 10.00 | 2023-10-26 |

The consensus view among analysts might be a “hold” rating, reflecting a balanced outlook on FCPGX’s potential. However, differing opinions highlight the inherent uncertainty in stock market predictions.

Investment Strategies Related to FCPGX

Several investment strategies can be employed when considering FCPGX, each with its own risk and reward profile.

Let’s illustrate potential returns and risks using hypothetical scenarios:

Buy-and-Hold: Assume an initial investment of $10,000 at a price of $10 per share. If the price rises to $15 in 5 years, the return would be 50%. However, if the price drops to $5, the loss would be 50%.

Value Investing: If FCPGX is undervalued based on its intrinsic value, a value investor might purchase shares expecting the market to eventually recognize its true worth.Monitoring the FCPGX stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider similar companies; a good benchmark might be the performance of the compass group stock price , given their operational similarities. Ultimately, understanding FCPGX’s trajectory involves assessing its own performance against the broader industry context, including competitors like Compass Group.

Potential returns are higher but depend on accurate valuation.

Growth Investing: A growth investor would focus on FCPGX’s growth potential. High potential returns are possible, but this strategy is riskier if the company fails to meet growth expectations.

Buy-and-hold offers simplicity but may not maximize returns. Value investing requires thorough analysis but can yield significant gains. Growth investing is high-risk, high-reward, dependent on accurate prediction of future growth.

FAQ Resource: Fcpgx Stock Price

What is FCPGX?

FCPGX is a stock ticker symbol representing a specific company (the full name would need to be provided separately). This analysis focuses on the performance and valuation of this stock.

Where can I find real-time FCPGX stock price data?

Real-time stock price data is available through various financial websites and brokerage platforms. Reputable sources include major financial news websites and your brokerage account.

What are the risks associated with investing in FCPGX?

Investing in any stock carries inherent risks, including potential loss of principal. Specific risks for FCPGX would depend on factors like market volatility, company performance, and economic conditions. Always diversify your investments.

Is FCPGX a good investment?

Whether FCPGX is a “good” investment depends entirely on your individual risk tolerance, investment goals, and financial situation. This analysis provides information to aid your decision-making, but it is not financial advice.