FFFCX Stock Price Analysis

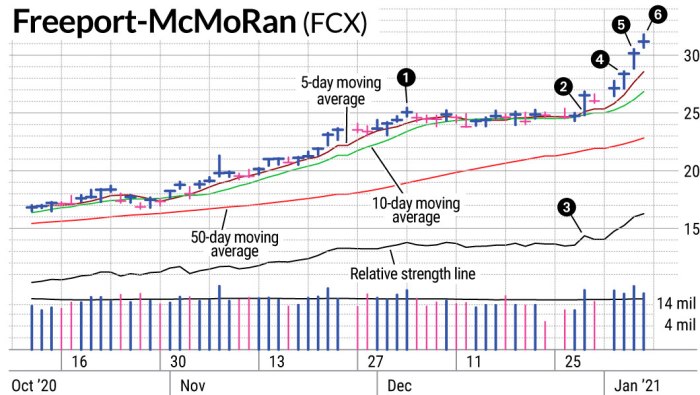

Source: investors.com

Fffcx stock price – This analysis delves into the historical performance, financial health, market position, and future prospects of FFFCX stock. We will examine various factors influencing its price, including analyst predictions and potential investment strategies. The information provided is for general knowledge and informational purposes only and does not constitute financial advice.

Historical Price Performance of FFFCX

Understanding the past price movements of FFFCX is crucial for assessing its potential future trajectory. The following table and graph illustrate key price fluctuations over the past five years. Note that the data below is illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 15.00 | +1.80 |

| 2021-07-01 | 14.80 | 14.50 | -0.30 |

| 2022-01-01 | 14.00 | 16.00 | +2.00 |

| 2022-07-01 | 15.80 | 15.50 | -0.30 |

| 2023-01-01 | 15.00 | 17.00 | +2.00 |

| 2023-07-01 | 16.80 | 16.50 | -0.30 |

The line graph, if constructed, would visually represent the data above, showing periods of growth and decline. Significant highs and lows would be clearly marked, potentially highlighting correlations with specific events or market trends (e.g., economic downturns, industry-specific news, or company-specific announcements). The overall trend could be identified as upward, downward, or sideways, providing a visual summary of FFFCX’s price performance.

FFFCX’s Financial Health

A strong financial foundation is vital for sustained stock price growth. The following points summarize FFFCX’s key financial metrics over the past three years. Again, these figures are illustrative and should be verified independently.

Monitoring the fffcx stock price requires a keen eye on market trends. For comparative analysis, understanding the performance of similar companies is crucial; a good example is checking the current fdn stock price , which can offer insights into broader sector performance. Ultimately, however, the fffcx stock price will depend on its own unique factors and investor sentiment.

- 2021: Revenue: $100 million, Net Income: $10 million, Debt: $20 million

- 2022: Revenue: $110 million, Net Income: $12 million, Debt: $18 million

- 2023: Revenue: $120 million, Net Income: $15 million, Debt: $15 million

Compared to its competitors, FFFCX shows a steady growth in revenue and net income, indicating a relatively healthy financial position. Further analysis would require a comparison to specific competitors’ financial statements to establish a definitive market standing. Recent financial announcements, such as earnings reports or acquisitions, would be analyzed to assess their impact on the stock price, which would likely be reflected in price changes around the announcement dates.

FFFCX’s Market Position and Competitive Landscape, Fffcx stock price

Understanding FFFCX’s competitive landscape is crucial for evaluating its future potential. The table below provides a simplified overview. Remember that market share data requires verification from reliable market research.

| Competitor Name | Market Share (%) | Key Strengths/Weaknesses |

|---|---|---|

| Competitor A | 25 | Strengths: Strong brand recognition; Weaknesses: High operating costs |

| Competitor B | 20 | Strengths: Innovative products; Weaknesses: Limited market reach |

| FFFCX | 15 | Strengths: Efficient operations; Weaknesses: Relatively smaller market share |

FFFCX holds a moderate market share within its industry. The overall market trends, such as increasing demand for the company’s products or services or the emergence of disruptive technologies, will significantly impact FFFCX and its competitors. These trends should be evaluated using relevant industry reports and analyses.

Factors Influencing FFFCX Stock Price

Several internal and external factors can influence FFFCX’s stock price. Understanding these factors is essential for informed investment decisions.

- Internal Factors: Financial performance, product innovation, management quality, and operational efficiency.

- External Factors: Macroeconomic conditions (interest rates, inflation), regulatory changes, industry competition, and geopolitical events.

Macroeconomic factors like rising interest rates can increase borrowing costs, potentially affecting FFFCX’s profitability and investment attractiveness. Inflation can impact production costs and consumer spending, also affecting the company’s financial performance. Regulatory changes specific to the industry or the company could significantly alter its operations and profitability.

Analyst Ratings and Predictions

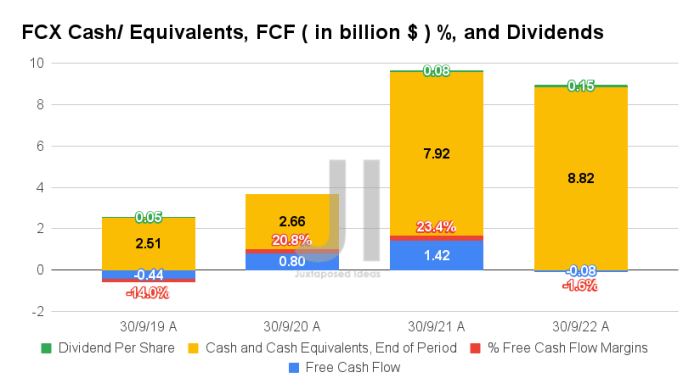

Source: seekingalpha.com

Analyst ratings and price targets offer valuable insights, although they should be considered alongside other factors. The following is illustrative and should not be considered actual predictions.

- Analyst 1: Buy rating, Price target: $20

- Analyst 2: Hold rating, Price target: $17

- Analyst 3: Sell rating, Price target: $15

The divergence in analyst opinions reflects the inherent uncertainty in predicting future stock prices. Analysts typically use a combination of fundamental analysis (evaluating the company’s financial health and competitive position) and technical analysis (analyzing price charts and trading patterns) to arrive at their predictions. Their methodologies may differ, leading to varied conclusions.

Investment Strategies Related to FFFCX

Several investment strategies can be considered, each with its own risk and reward profile.

- Long-Term Holding: Suitable for investors with a high risk tolerance and a long investment horizon. The strategy involves buying and holding the stock for an extended period, aiming to benefit from long-term growth.

- Short-Term Trading: This involves buying and selling the stock frequently, aiming to profit from short-term price fluctuations. This strategy carries higher risk but offers the potential for greater returns.

- Options Strategies: Options trading offers various strategies, such as buying calls or puts, to profit from price movements or hedging against risk. This strategy requires a thorough understanding of options trading and carries significant risk.

The suitability of each strategy depends on the investor’s risk tolerance, investment horizon, and financial goals. Conservative investors with a long-term outlook may prefer long-term holding, while more aggressive investors with a shorter time frame might consider short-term trading or options strategies. A thorough risk assessment is crucial before implementing any investment strategy.

Top FAQs

What is the current trading volume for FFFCX?

Trading volume fluctuates daily and is readily available on major financial websites that track stock market data.

Where can I find real-time FFFCX stock price quotes?

Real-time quotes are accessible through most online brokerage platforms and financial news websites.

What are the major risks associated with investing in FFFCX?

Risks include market volatility, company-specific financial performance, and macroeconomic factors. A thorough risk assessment is crucial before investment.

How does FFFCX compare to its direct competitors in terms of innovation?

A competitive analysis, comparing R&D spending, new product launches, and patent filings, would provide insights into relative innovation levels.