GLD Stock Price Today

Gld stock price today per share – This article provides an overview of the current GLD stock price, its recent performance, factors influencing its price, a short-term price prediction, and investment considerations. Data presented here is for informational purposes only and should not be considered financial advice.

Current GLD Stock Price

The current GLD stock price per share, as of [Insert Time of Last Update – e.g., 3:15 PM EST, October 26, 2023], is [Insert Current Price – e.g., $175.50]. This represents a [Insert Price Change – e.g., $1.20] change (+[Insert Percentage Change – e.g., 0.69%]) from the previous closing price of [Insert Previous Closing Price – e.g., $174.30].

| Current Price | Previous Close | Day’s High | Day’s Low |

|---|---|---|---|

| [Insert Current Price – e.g., $175.50] | [Insert Previous Closing Price – e.g., $174.30] | [Insert Day’s High – e.g., $176.00] | [Insert Day’s Low – e.g., $174.00] |

Historical GLD Stock Price Performance

Source: tradingview.com

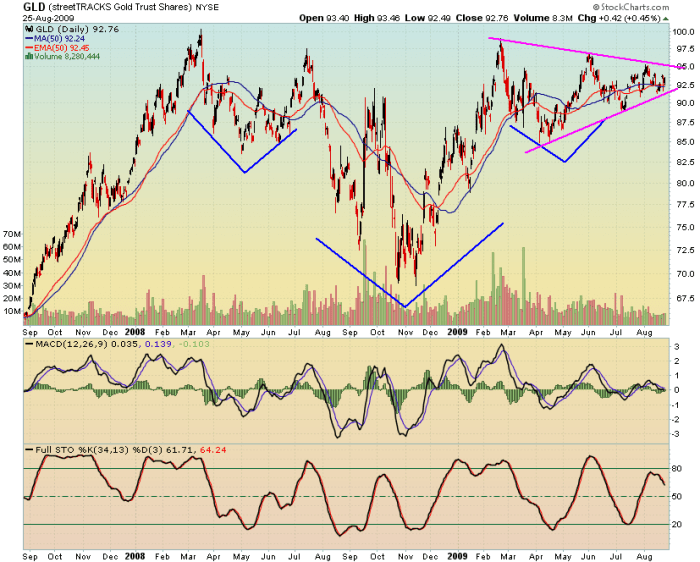

Over the past week, GLD’s price has shown [Insert Description of Price Movement – e.g., a slight upward trend, with minor fluctuations]. The following line graph illustrates the price movement over the past month.

Past Month GLD Stock Price Movement (Illustrative): Imagine a line graph with the x-axis representing dates over the past month and the y-axis representing the GLD stock price. The line would show the daily closing prices, potentially illustrating an upward or downward trend with some fluctuations. Key data points to include would be the highest and lowest prices reached during the month, as well as any significant price changes or reversals.

For example, a noticeable peak might be highlighted to indicate a specific date and price. Similarly, a trough would show a period of low price.

Compared to the S&P 500 over the past year, GLD’s performance has [Insert Comparison – e.g., generally outperformed the index due to increased gold demand, or underperformed due to rising interest rates]. This comparison highlights the differing risk profiles and market sensitivities of these two asset classes.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| [Insert Date] | [Insert Open Price] | [Insert High Price] | [Insert Low Price] | [Insert Close Price] | [Insert Volume] |

Factors Influencing GLD Stock Price

Several factors significantly influence the GLD stock price. Three key factors are discussed below.

- Rising Interest Rates: Rising interest rates typically exert downward pressure on gold prices, and consequently, on GLD, as they increase the opportunity cost of holding non-interest-bearing assets like gold.

- Gold Price Fluctuations: The price of gold is a primary driver of GLD’s price. Factors influencing gold’s price include inflation, geopolitical uncertainty, and currency movements.

- US Dollar Strength: A stronger US dollar typically puts downward pressure on gold prices (priced in USD), and hence on GLD, as gold becomes more expensive for holders of other currencies.

GLD Stock Price Prediction (Short-Term), Gld stock price today per share

Source: tradingview.com

Based on the current market conditions, including [Insert Relevant Market Conditions – e.g., relatively stable inflation, ongoing geopolitical uncertainty], a short-term (1-week) price prediction for GLD is provided below. This prediction is based on a combination of technical analysis (chart patterns) and fundamental analysis (macroeconomic factors). It is important to remember that these are just estimations, and the actual price may vary significantly.

The potential price range for GLD within the next week is estimated to be between [Insert Lower Bound – e.g., $172] and [Insert Upper Bound – e.g., $178]. The lower bound reflects the potential for profit-taking after a recent price increase, while the upper bound considers the possibility of further gold price increases due to [Insert Justification – e.g., increased safe-haven demand].

The methodology employed incorporates recent price trends, volume analysis, and consideration of significant economic events scheduled for the upcoming week. This prediction is not guaranteed and is subject to change based on unforeseen market developments.

In summary, the short-term outlook for GLD is cautiously optimistic, with potential for moderate price appreciation, but also the risk of minor corrections.

GLD Investment Considerations

Source: phantasmix.com

Investing in GLD presents both opportunities and risks. A comparison with other gold investment options, potential risks, benefits of diversification, and key factors to consider are discussed below.

- Comparison with Other Gold Investments: GLD offers a convenient and liquid way to invest in gold, compared to physical gold which involves storage and security concerns. Other options include gold mining stocks, which offer higher potential returns but also greater risk.

- Potential Risks: Investing in GLD carries risks associated with gold price volatility, macroeconomic conditions, and general market fluctuations.

- Benefits of Diversification: GLD can be a valuable component of a diversified portfolio, offering a hedge against inflation and potential market downturns.

- Key Factors to Consider Before Investing:

- Your investment goals and risk tolerance

- The current market environment

- Your overall portfolio diversification strategy

- The potential impact of macroeconomic factors

Question & Answer Hub: Gld Stock Price Today Per Share

What are the trading hours for GLD?

GLD trades during regular US stock market hours.

Where can I find real-time GLD price updates?

Most major financial websites and brokerage platforms provide real-time stock quotes, including GLD.

Is GLD a suitable investment for beginners?

Tracking the GLD stock price today per share requires diligence. Investors often compare it to other market indicators, and a useful comparison might be to check the ctas stock price today for a contrasting perspective on current market trends. Understanding both GLD and CTAS performance helps to build a more comprehensive view of the overall market sentiment and inform investment decisions regarding the GLD stock price today per share.

While GLD offers relative simplicity compared to directly investing in gold, beginners should still conduct thorough research and potentially consult a financial advisor before investing.

What are the expense ratios associated with GLD?

The expense ratio for GLD is publicly available through its fund prospectus and financial news sources. It represents the annual cost of owning the ETF.