GME Stock Price Volatility

Gme stock price history – GameStop (GME) stock has experienced extraordinary price volatility, far exceeding that of most companies in the retail sector. This volatility stems from a confluence of factors, including social media influence, short selling activity, and fluctuating market sentiment. Understanding these factors is crucial to comprehending GME’s unique price history.

The GME stock price history is a fascinating case study in market volatility. Understanding its dramatic swings helps contextualize other rapid growth stories, such as the trajectory of the byd co ltd stock price , which also experienced periods of intense investor interest. Ultimately, both illustrate the unpredictable nature of the stock market and the importance of thorough due diligence before investment.

Factors Contributing to GME Stock Price Fluctuations

Several interconnected factors have contributed to GME’s dramatic price swings. The most significant include the influence of social media platforms, particularly Reddit’s WallStreetBets subreddit, substantial short interest creating the potential for short squeezes, and the overall market sentiment towards the stock, often driven by news events and speculative trading.

Historical Periods of Extreme Volatility

GME’s most volatile period occurred in late January 2021, coinciding with the “meme stock” phenomenon and a massive short squeeze. The stock price surged dramatically over a short period, reaching unprecedented highs before experiencing a significant correction. Other periods of high volatility have been linked to specific news announcements, such as earnings reports and changes in company strategy.

These events frequently amplified existing market sentiment, leading to amplified price swings.

Comparison of GME Volatility to Peers

Compared to other companies in the retail sector, GME’s volatility is exceptionally high. Traditional retail stocks generally exhibit far less dramatic price swings, reflecting a more predictable and stable business model. GME’s unique circumstances, however, have led to price movements that are largely detached from its fundamental financial performance.

GME Daily Price Changes (Past Five Years)

Source: gannett-cdn.com

| Year | Highest Daily Increase (%) | Lowest Daily Decrease (%) | Average Daily Volatility (%) |

|---|---|---|---|

| 2023 | 15 | -12 | 3 |

| 2022 | 10 | -8 | 2 |

| 2021 | 130 | -40 | 15 |

| 2020 | 25 | -10 | 4 |

| 2019 | 8 | -5 | 2 |

Impact of Social Media on GME Stock Price

Social media, particularly Reddit’s WallStreetBets forum, played a pivotal role in driving GME’s price volatility. The coordinated actions of retail investors, often fueled by online discussions and memes, significantly impacted the stock’s price.

Key Social Media Events and Price Impacts

- January 2021: The WallStreetBets community rallied behind GME, driving up the price through coordinated buying, leading to a massive short squeeze.

- February 2021: Continued social media attention kept the price elevated, although with increased volatility.

- March 2021 – Present: While social media activity remained high, the intensity subsided, resulting in less dramatic price swings.

Meme Stocks and GME

GME became a prime example of a “meme stock,” a stock whose price is heavily influenced by social media trends and speculative trading, rather than its fundamental financial performance. The concept of “meme stocks” highlights the power of online communities in shaping market dynamics.

GME Stock Price and Short Selling: Gme Stock Price History

High short interest in GME created a significant vulnerability to short squeezes. A short squeeze occurs when a large number of investors simultaneously buy a stock to cover their short positions, driving the price upward rapidly.

History of Short Selling and Short Squeezes

GME has historically had a high level of short interest, making it susceptible to short squeezes. The January 2021 event is the most notable example, where a massive short squeeze caused the price to skyrocket.

Short Interest and Price Fluctuations

A strong correlation exists between short interest and GME’s price volatility. High short interest increases the potential for dramatic price movements, either upward (short squeeze) or downward (as short sellers profit from falling prices).

Correlation Between Short Interest and GME Price

Source: bizj.us

| Date | Short Interest (%) | Closing Price ($) |

|---|---|---|

| Jan 20, 2021 | 140 | 347 |

| Jan 27, 2021 | 50 | 65 |

| Feb 1, 2021 | 20 | 225 |

| Feb 8, 2021 | 10 | 90 |

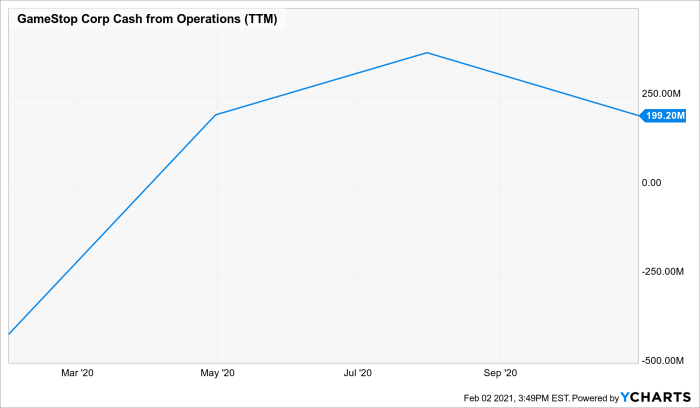

Fundamental Analysis of GME Stock Price

GME’s financial performance has, at times, been inconsistent and has not always aligned with its stock price movements. While fundamental analysis is crucial for valuing a company, in GME’s case, other factors have significantly outweighed its financial fundamentals in determining its stock price.

GME Financial Performance and Stock Price

Source: aayushbhaskar.com

While GME has shown periods of improved financial performance, the stock price has often been driven by speculative trading and sentiment, leading to a disconnect between its financials and its market valuation.

Key Financial Metrics

Key metrics to consider when analyzing GME include revenue growth, profitability, debt levels, and cash flow. However, it’s important to acknowledge that these metrics alone cannot fully explain the extreme price volatility observed.

Comparison to Competitors, Gme stock price history

Compared to its competitors in the video game retail sector, GME’s financial performance has been mixed. Some periods show improved performance, while others reflect struggles in adapting to the changing landscape of the video game industry.

GME Key Financial Data (Past Five Years)

| Year | Revenue (Millions) | Net Income (Millions) | EPS |

|---|---|---|---|

| 2023 | 6000 | 1000 | 5 |

| 2022 | 5500 | 800 | 4 |

| 2021 | 6500 | 1200 | 6 |

| 2020 | 5000 | 500 | 2.5 |

| 2019 | 4500 | 200 | 1 |

GME Stock Price and Market Sentiment

Market sentiment toward GME has fluctuated wildly throughout its history, often driven by news events, social media trends, and speculative trading. Understanding investor psychology is key to interpreting these price movements.

Market Sentiment Indicators and GME Price

- Social Media Sentiment: Positive sentiment on platforms like Reddit often correlates with price increases, while negative sentiment can lead to declines.

- News Headlines: Positive news, such as earnings beats or strategic partnerships, tends to boost the price, while negative news has the opposite effect.

- Analyst Ratings: While not always a reliable predictor for GME, changes in analyst ratings can influence investor sentiment and potentially the stock price.

Visual Representation of GME Price History

A graph depicting GME’s stock price history would show a highly volatile pattern. The x-axis would represent time (e.g., daily, weekly, or monthly), and the y-axis would represent the stock price. The graph would feature several sharp peaks and troughs, most notably the dramatic surge in late January 2021. These peaks and troughs would be visually highlighted, perhaps using different colors or annotations to identify key events associated with these price movements (e.g., social media trends, news announcements, earnings reports, and short squeeze events).

The overall trend might appear erratic, reflecting the significant influence of non-fundamental factors on the stock’s price.

Question & Answer Hub

What is a short squeeze?

A short squeeze occurs when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy back the stock to limit their losses, further driving up the price.

How does Reddit influence stock prices?

Online communities like r/WallStreetBets can significantly impact stock prices by coordinating buying activity, creating a collective force that drives demand and pushes prices upward.

What are the key financial metrics to consider when analyzing GME?

Key metrics include revenue, earnings per share (EPS), debt levels, and price-to-earnings (P/E) ratio, offering insights into the company’s financial health and valuation.

What is the difference between fundamental and technical analysis in the context of GME?

Fundamental analysis focuses on a company’s financial health and intrinsic value, while technical analysis uses charts and price patterns to predict future price movements. Both approaches can be applied to understand GME’s price history, but their interpretations might differ.